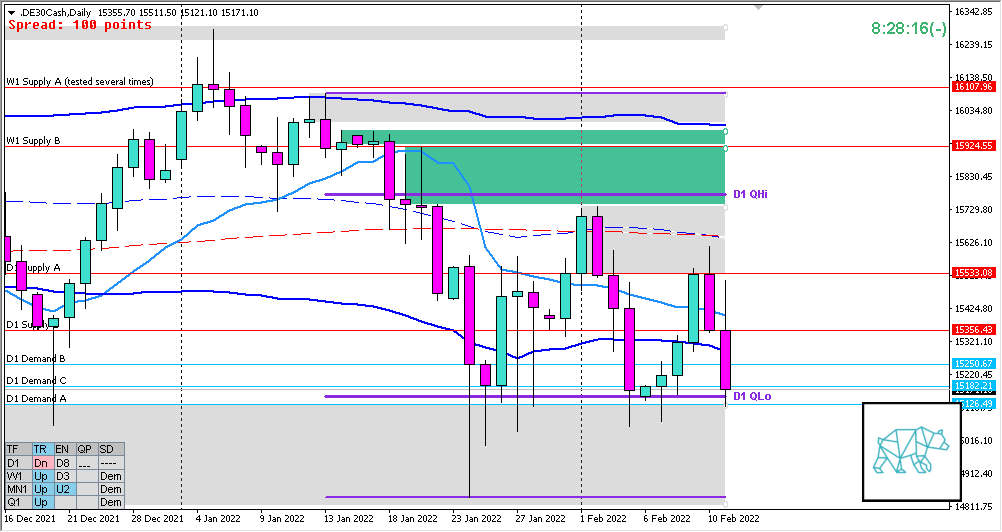

12 Feb DAX 2022 Week 7 Trading Plan

#Fintwit #DAX #DE30Cash #Orderflow #daytrading #daytrade #forex #FX #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #index #indices

This is my weekly outlook on DAX. The levels that I will be looking at with a higher probabilistic chance the market will start reacting. During the session I then wait for the market to hit those levels and either confirm or reject my bias through price action confirmation and order flow. I hope that makes sense. If not, get in touch with me. I love to talk to people that are on the same path as me. So don’t be shy and reach out.

Monthly — Neutral

- Last month closed as an Inside Bar after having extended to both sides the range of the preceding month

- Even though Inside Bar closed down it closed with a longer buying wick

- Range has not been broken (yet)

- Possible Phase 1 / 3

- Possible developing MN Three Outside Down

Weekly — Bearish

- Price closed slightly lover as a Gravestone Doji without extending the previous range down

- Possible developing W1 DBD

Daily — Bearish

- Price reacted off D1 Supply Forming a D1 Three Inside Down giving new D1 supply and price closed above D1 QLo

Sentiment summary — Bearish

- MN is possibly developing a MN Three Outside Down which could indicate momentum behind a possible breakdown. Although no close yet.

- W1 W1 keeps closing lower although last week’s price did not break the previous week’s range, it did develop a possible base and could see a continuation. Price is still trading within W1 demand though.

- D1 Three Inside Down indicating possible momentum (although price did not close deep within demand) if price can continue further down breaking demand. A retracement to newly formed demand wouldn’t be the strongest bearish sign.

Additional notes

- N.A.

Focus Points for trading development

- Monthly Goals

- No momentum trades on Non-Farm Fridays

- Total of 15 trades by the end of the month, can take 2 a day (not in the same product at the same time)

- No early exits, either hit SL or target

- Use SL scaling in case the profit target for the setup doesn’t provide 2R for example for FA or VAA setups

- Process

- Keep trade review comments short

- Risk Management

- 2 consecutive days of lack of sleep = NO TRADING

No Comments