27 Jul DE30 DAX Week 31 Trading Plan

DE30 DAX Week 31 Trading Plan

#daytrade #daytrading #forex #FX #INDEX #INDICES #DAX #DE30 #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #tradingforex #daytrading

This is my weekly outlook on DE30 otherwise known as DAX. Basically the levels that I will be looking at where it has a higher probabilistic chance the market will start reacting. During the session I then wait for the market to hit those levels and either confirm or reject my bias through price action confirmation and market profile. I hope that makes sense. If not, please get in touch with me. I love to talk to people that are on the same path as me.

Monthly — Slightly Bullish

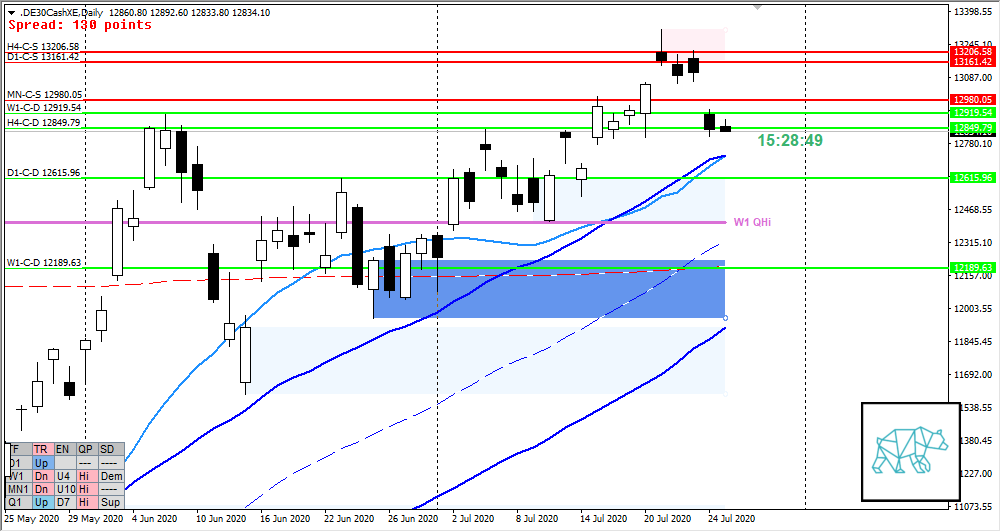

- After a V‑shaped recovery creating MN-C‑D 10825.85 price re-entered Q1 QHi and is testing MN-C‑S 12980.05

- Arrival at supply isn’t entirely clean since last month we tested the level as well

- Developing month’s price trading above preceding month’s body and currently trading within its range after extending higher into overhead supply

Weekly — Slightly Bullish

- Weekly demand created at W1-C‑D 12189.63 after what looked like a rejection of MN1 QHi but then proceeded to trade higher

- Almost reached overhead supply at W1-C‑S 13550.48 before consolidating (through a hammer and shooting star) and creating new demand just below MN-C‑S 12980.05 with W1-C‑D 12919.54

Daily — Slightly Bullish

- D1-C‑D 12615.96 demand created through a bear engulf staying within W1 QHi

- D1-C‑S 13161.42 supply created through some consolidation

- Price trading above UKC and VWAP but in the middle of D1 Q points

H4 — Slightly Bearish to Neutral

- H4 Bear Engulf creating supply H4-C‑S 13206.58 with unclean move away but testing supply again with clean rejection through an evening star to then have price return to H4-C‑D 12849.79 but with unclean arrival

Market Profile — Neutral

- After little bracketing price gapped down and has traded within its range from last Friday

- Currently LN opened within value and tried to reject value but failed

Sentiment summary — Neutral to slightly bullish

- Low to medium time frames give a more neutral sentiment to even some bearish sentiment so would need more confirmation in terms of direction. Higher time frames are more bullish.

ZOIs for Possible Shorts

- MN-C‑S 12980.05

- W1-C‑S 13550.48

- D1-C‑S 13161.42

ZOIs for Possible Long

- MN-C‑D 10825.85

- W1-C‑D 12189.63

- W1-C‑D 12919.54

- D1-C‑D 12615.96

- H4-C‑D 12849.79

Focus Points for trading development

- Weekly Goal

- Have correct SL placement and position sizing

- Due to summer time I will focus on trading off newly formed SD ZOIs for intraday plays. Keeping in mind that due to lack of liquidity 2nd chance entries can give better R/R using the M30/M15 rule.

- Risk Management

- Only take 2 trades a day but only have 1 active trade on between the assets

- Only trade off M30 candles

- Trading Priority

- FX pair outside value

- FX pair inside > Gold

- 2+R profit during LN consider trading PNYC

- After 4 losing trades reduce TP to 1.5R but after 1R can consider taking profits

- 2 consecutive days of lack of sleep = NO TRADING

No Comments