12 Jun GBPNZD 2021 Week 24 Trading Plan

#Fintwit #Orderflow #daytrading #daytrade #forex #FX #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #GBPNZD

This is my weekly outlook on GBPNZD. The levels that I will be looking at with a higher probabilistic chance the market will start reacting. During the session I then wait for the market to hit those levels and either confirm or reject my bias through price action confirmation and order flow. I hope that makes sense. If not, please get in touch with me. I love to talk to people that are on the same path as me. So don’t be shy and reach out.

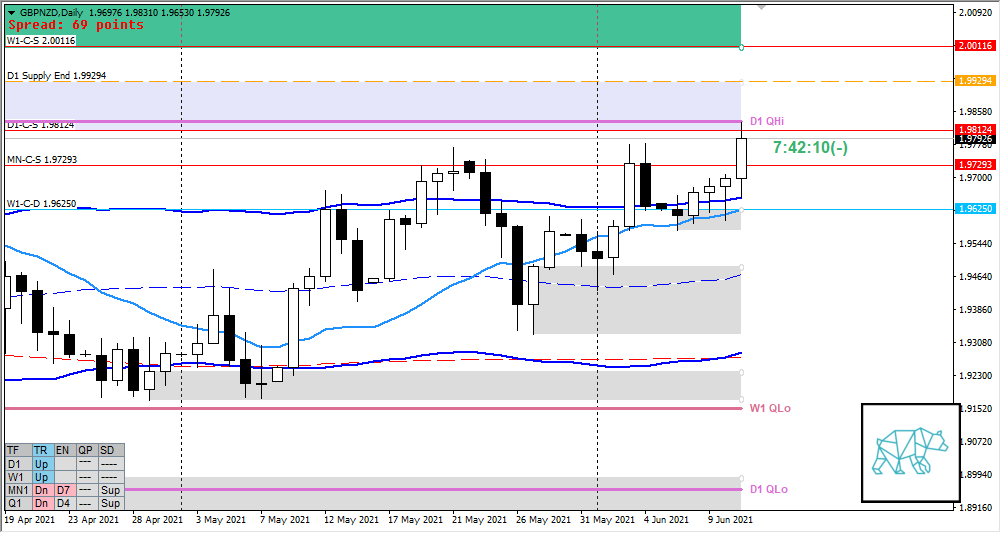

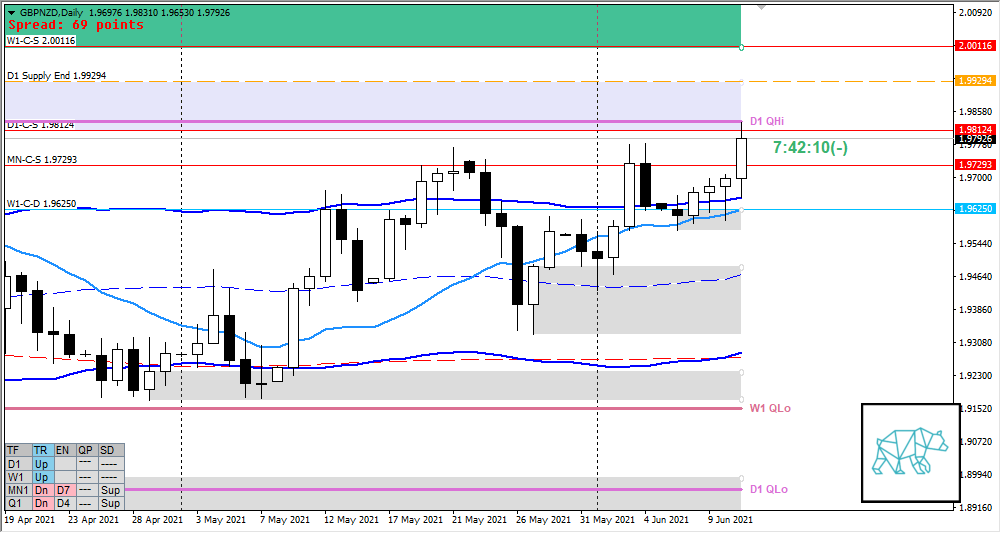

Monthly — Slightly Bullish

- Price tested MN-C‑S 1.97293 5 times but has not taken it out

- Last month closed as a Bullish Inside Bar but with a selling wick

- Price is currently trading above last month’s body and above range and made a slight HH

- Price is trading mid MN swing

Weekly — Slightly Bullish

- Price took out W1 Supply and made a HH closing as a W1 Three Inside Up (near its high) giving W1-C‑D 1.96250

- Price trading mid W1 swing (coming from a W1 QLo rejection)

Daily — Slightly Bullish

- D1 Bull Engulf formed at W1 C‑dem and continuation higher (after testing newly formed 2 / 3 times) taking out D1 Supply

- Price arrived at D1 QHi and D1-C‑S 1.98124 OLD (has been tested multiple times)

Sentiment summary — Slight Bullish

- Price traded above last month range making a slight HH trading deeper into MN supply

- W1 closed bullish taking out W1 supply and has 220 pips to go to W1-C‑S 2.00116

- D1 traded higher taking out D1 Supply and is currently testing D1-C‑S 1.98124 that has been tested multiple times and is thus weaker.

- Coming from a W1 QLo rejection there could be a push through D1 QHi

Additional notes

- N.A.

ZOIs for Possible Shorts

- W1-C‑S 2.00116

- MN-C‑S 1.97293

- D1-C‑S 1.98124

ZOIs for Possible Long

- W1-C‑D 1.96250

Focus Points for trading development

- Monthly Goals

- No momentum trades on Non-Farm Fridays

- Total of 13 trades by the end of the month

- Weekly Goal

- Min. 3 times working out at home + mandatory cardio

- Risk Management

- Without forcing a trade: aim to take 1 trade a day, if possible 2.

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING