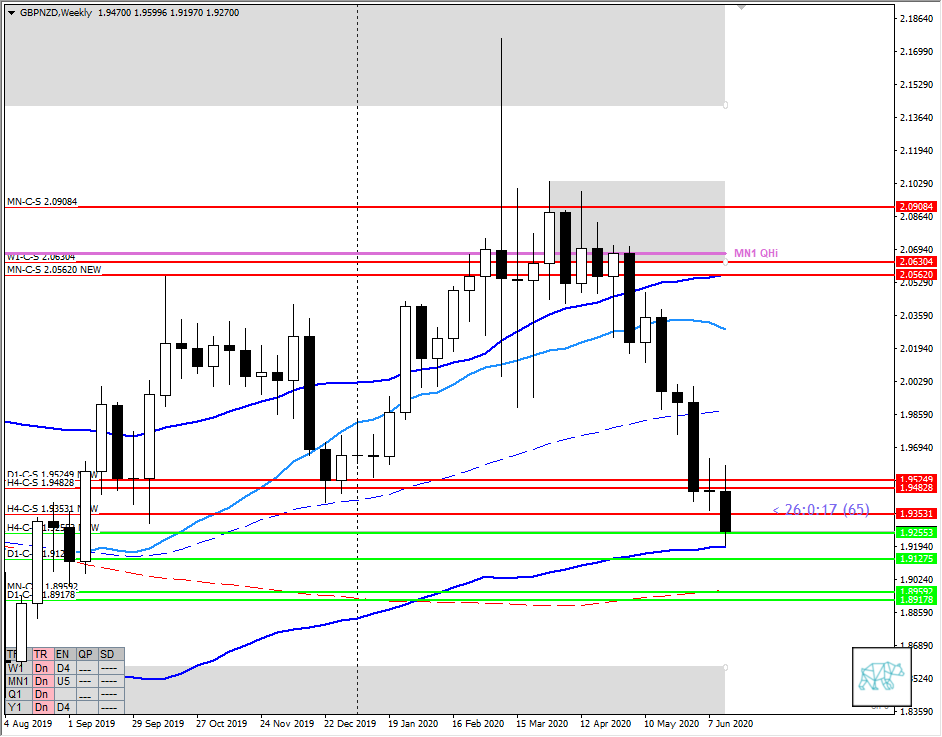

21 Jun GBPNZD — Week 26 Trading Plan

This is my weekly outlook on the Forex pair XAUUSD. Basically the levels that I will be looking at where it has a higher probabilistic chance the market will start reacting. During the session I then wait for the market to hit those levels and either confirm or reject my bias through price action confirmation and market profile. I hope that makes sense. If not, please get in touch with me. I love to talk to people that are on the same path as me. So don’t be shy and reach out.

Monthly — Bearish

- Normal formation supply at MN-C‑S 2.09084 with a bear engulf giving MN-C‑S 2.05620 NEW and consequent drop. However it hasn’t reached MN-C‑D 1.89592 (yet)

Weekly — Bearish

- Phase 3 followed by multiple DBD move away from W1-C‑S 2.06304 running into some congestion at LKC and extended from VWAP

- Last week closed down after a doji was formed the week prior taking out previous demand. Previous week bar shorter than previous drop.

Daily — Slightly Bearish

- Price below VWAP and LKC

- Bull Engulf at previous demand consequently taken out by bear engulf forming new supply D1-C‑S 1.95249 NEW.

- Move away followed by congestion through consolidation and consequent break down of demand nearing W1 QLo and demand D1-C‑D 1.91275

H4 — Slightly Bearish

- Move away from H4-C‑S 1.94828 broke down from range forming new supply H4-C‑S 1.93531 NEW

- New demand formed through inside bar at H4-C‑D 1.92553 NEW but not near D1 QLo yet

Market Profile

- Last 2 days had wider value areas but still closed lower

Sentiment summary — Slightly Bearish

- Due to not quite having reached D1 and W1 QLo as well as demand there might be some more downside on the short/medium term before we can reassess a possible phase 1 and consequent reversal or a continuation. Potential backup for this is last week’s bar being shorter indicating fading of momentum and combined with underlying demand there might be a thesis for this but will need intraweek analysis to back any further bias in sentiment.

ZOIs for Possible Shorts

- H4-C‑S 1.93531 NEW

- H4-C‑S 1.94828

- D1-C‑S 1.95249 NEW

ZOIs for Possible Long

- H4-C‑D 1.92553 NEW

- D1-C‑D 1.91275

- MN-C‑D 1.89592

- D1-C‑D 1.89178