01 Feb GBPNZD Week 5 Trading Plan

#Fintwit #Orderflow #daytrading #daytrade #forex #FX #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #GBPNZD

This is my weekly outlook on the Forex pair GBPNZD. Basically the levels that I will be looking at where it has a higher probabilistic chance the market will start reacting. During the session I then wait for the market to hit those levels and either confirm or reject my bias through price action confirmation and order flow through market profile. I hope that makes sense. If not, please get in touch with me. I love to talk to people that are on the same path as me. So don’t be shy and reach out.

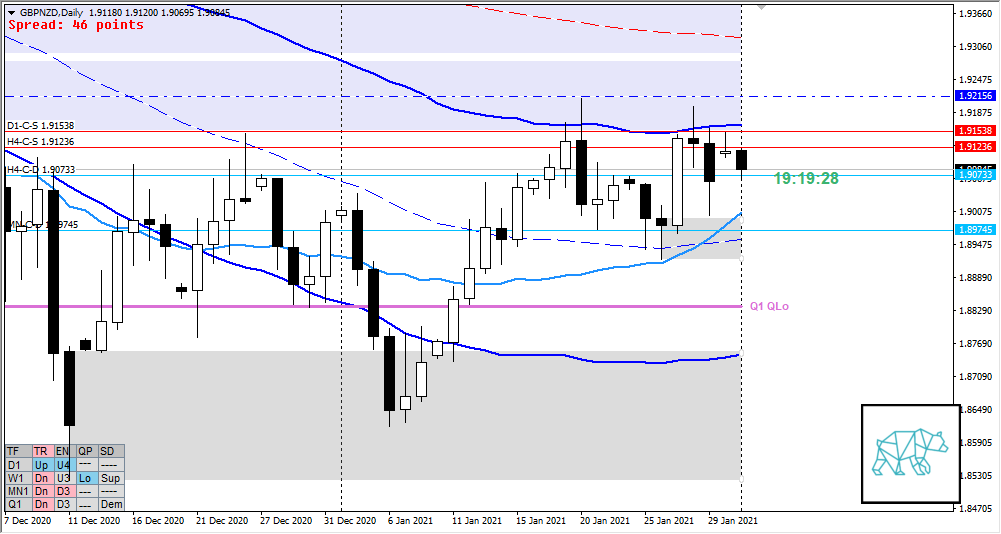

Monthly — Slightly Bullish

- MN Dragonfly doji at MN-C‑D 1.89745 in December, with last month completing a Morning Star with a long buying wick although not closing far above MN-C‑D 1.89745.

Weekly — Slightly Bullish

- W1 Bull Engulf forming demand on top of MN-C‑D 1.89745 followed by a Gravestone Doji forming some supply and followed by a slight push higher leaving a longer buying wick behind but hasn’t taking out said supply (yet).

- Price trading at VWAP in DT at LKC

Daily — Neutral to Slightly Bullish

- Multiple tests of D1-C‑S 1.91538 (and UKC in R) forming an Evening Star leaving a buying wick behind reacting off newly formed D1 demand at MN-C‑D 1.89745

- Possible Phase 1

- Price nearing D1 200MA in DT

H4 — Neutral

- Price trading between H4-C‑D 1.90733 and H4-C‑S 1.91236

Market Profile — Imbalance

- Value area below previous after a UT

Sentiment summary — Imbalance

- The large time frame might be setting up for a move higher although the medium time frame would need to break through support taking out 1.92156 before we can confirm this. Ranges are still too tight though so will need institutions to get involved before we can get in on it too.

Additional notes

- Friday: non-farm

- Ranges still too tight

- BOE Monetary Policy Report

ZOIs for Possible Shorts

- D1-C‑S 1.91538

- H4-C‑S 1.91236

ZOIs for Possible Long

- MN-C‑D 1.89745

- H4-C‑D 1.90733

Focus Points for trading development

- Monthly Goals

- Continue tracking my DRC tracking sheet

- Focus on my own progress and less on others

- Feeling okay with NOT trading

- Have ‘quieter’ weekends

- Weekly Goal

- Min. 3 times hitting the gym + mandatory cardio

- Trading Rules

- Trade from D and upwards unless a possible momentum trade, value acceptance or otherwise.

- Risk Management

- 3 trades 1% risk, 3rd trade only if first 2 worked out

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING

No Comments