06 Sep Gold 2021 Week 36 Trading Plan

#Fintwit #Orderflow #daytrading #daytrade #forex #FX #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #Gold #XAUUSD

This is my weekly outlook on GOLD. The levels that I will be looking at with a higher probabilistic chance the market will start reacting. During the session I then wait for the market to hit those levels and either confirm or reject my bias through price action confirmation and order flow. I hope that makes sense. If not, please get in touch with me. I love to talk to people that are on the same path as me. So don’t be shy and reach out.

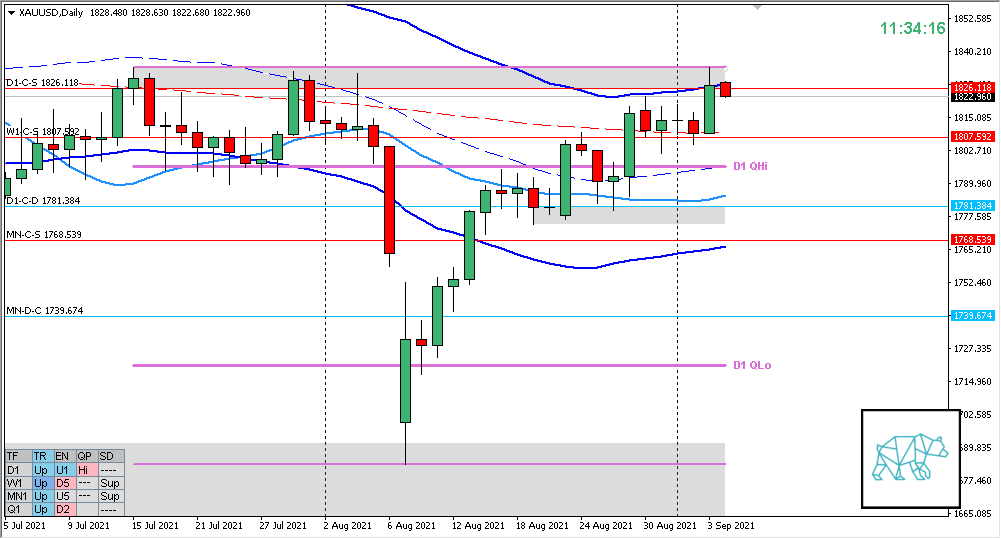

Monthly — Bearish

- Price formed a Bear Engulf (although to me it was more of a consolidation) back in June rejecting MN QHi with no follow-through. Instead price has been trading within the supply (MN-C‑S 1768.539) it had formed with last month closing as a DragonFly Doji reacting off MN-D‑C 1739.674 (coinciding with MN VWAP in UT TC).

- No high over July has been made (yet)

Weekly — Bullish

- W1 consolidation and break down Bear Engulf finisher giving W1-C‑S 1807.592 to a gap down and fill after reacting off MN-C‑D 1739.674 and rejecting W1 QLo. Price continued higher closing deeper into the supply.

Daily — Bullish

- Price rejected D1 QLo and has been trading higher arriving at D1 QHi with no rejection and price closed at D1-C‑S 1826.118

Sentiment summary — Bearish

- MN has failed to follow-through on the rejection coming from MN QHi (as of yet) although price trading in a large MN supply

- W1 showed a bounce and has not made a reversal in line with MN sentiment (yet) and there could be more upside if W1 supply gets taken out as W1 QLo has been rejected with no arrival at QHi (yet).

- D1 rejected QLo and is now trading within QHi at a supply. If that supply gets taken out there could be more upside.

Additional notes

- Sep 09, 19:45, EUR, ECB Interest Rate Decision

ZOIs for Possible Shorts

- D1-C‑S 1826.118

- W1-C‑S 1807.592

- MN-C‑S 1768.539

ZOIs for Possible Long

- MN-D‑C 1739.674

Focus Points for trading development

- Monthly Goals

- No momentum trades on Non-Farm Fridays

- Total of 13 trades by the end of the month

- Weekly Goal

- Weekly Focus Points

- Min. 3 times working out at home + mandatory cardio

- Trading rules

- Focus on taking ONE trade a day. If I missed the first DTTZ then a trade needs to be taken on the 2nd DTTZ unless there is a high/medium initiative activity day.

- Only price-action based exit rules (or if hit time stop comes earlier)

- M15/M30 entries and exits at 1st DTTZ, M5 entries and exits at 2nd DTTZ

- Buffer trades (profit target >1R) are allowed and encouraged

- Use SL scaling in case the profit target for the setup doesn’t provide 2R for example for FA or VAA setups

- No social media / messenger apps / phone calls allowed during the trading window

- Weekly Focus Points

- Risk Management

- Without forcing a trade: aim to take 1 trade a day, if possible 2.

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING

No Comments