05 Mar Gold 2022 Week 10 Trading Plan

#Fintwit #Gold #XAUUSD #Orderflow #daytrading #daytrade #forex #FX #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife

This is my weekly outlook on GOLD. The levels that I will be looking at with a higher probabilistic chance the market will start reacting. During the session I then wait for the market to hit those levels and either confirm or reject my bias through price action confirmation and order flow. I hope that makes sense. If not, get in touch with me. I love to talk to people that are on the same path as me. So don’t be shy and reach out.

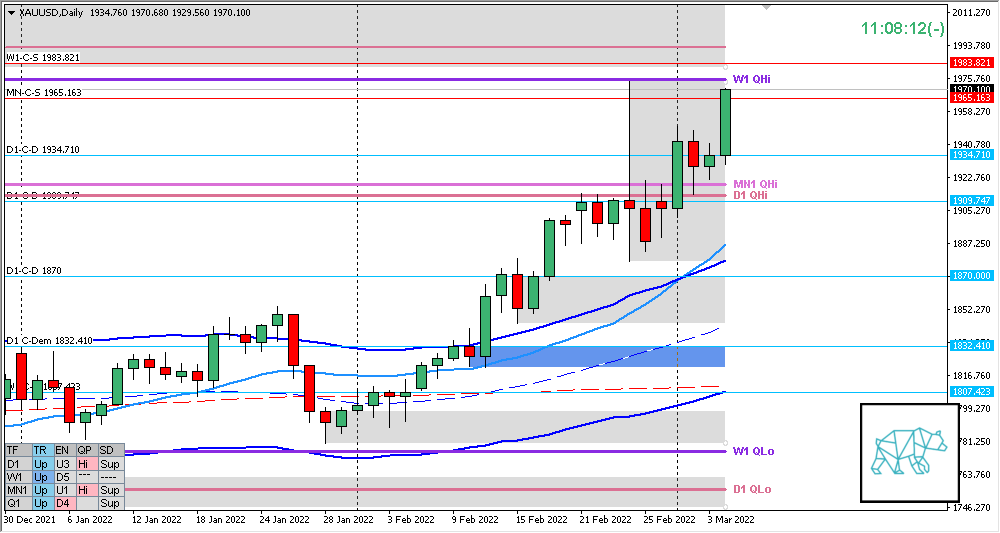

Monthly — Neutral

- MN closed as a RBR with some selling wick reacting off MN Supply and closing below MN QHi

- Price trading at MN-C‑S 1965.163

Weekly — Neutral

- Price followed through and closed higher near its high although not making a HH

- Price closed below W1 QHi (after already having tested it)

- W1 Supply right above QHi

Daily — Bullish

- D1 consolidation and break higher within D1 QHi (wide QHi)

- Price closed near its high although still trading within D1 Supply

Sentiment summary — Neutral

- MN Follow-through although no HH made and trading into MN QHi as wella s supply could see sellers coming in. No reversal (yet).

- W1 retraced the selling wick almost completely back to W1 QHi. Price Closed near its high although trading into QHi and supply could see sellers coming in. No reversal (yet).

- D1 Price consolidation and break higher, although price trading higher into QHi no reversal pattern (yet). Possibility for continuation higher but with larger timeframe supplies in the way the selling pressure can build up. I’ll let the profile guide my decisions.

Additional notes

- Due to the conflict in Russia there might be more buying pressure coming in

Focus Points for trading development

- Monthly Goals

- No momentum trades on Non-Farm Fridays

- No early exits, either hit SL or target

- Use SL scaling in case the profit target for the setup doesn’t provide 2R for example for FA or VAA setups

- Risk Management

- 2 consecutive days of lack of sleep = NO TRADING

No Comments