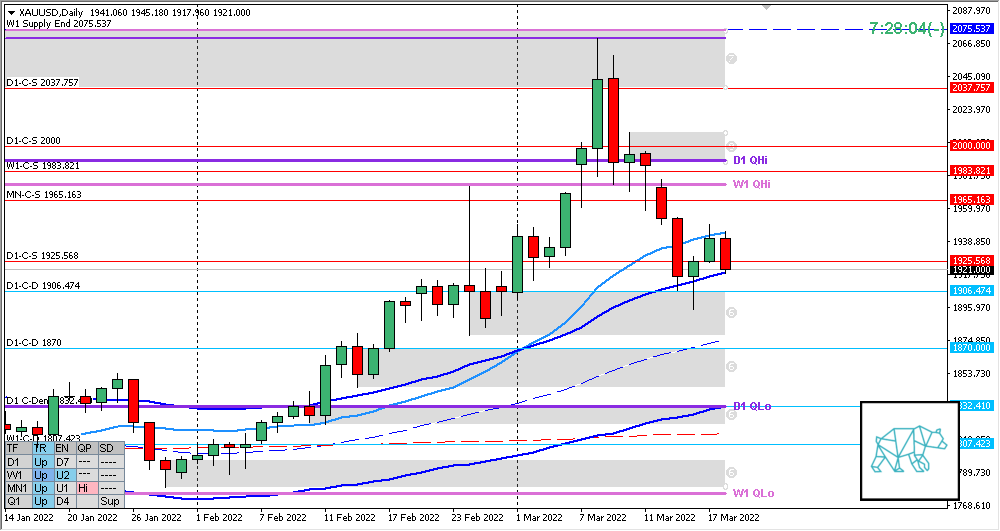

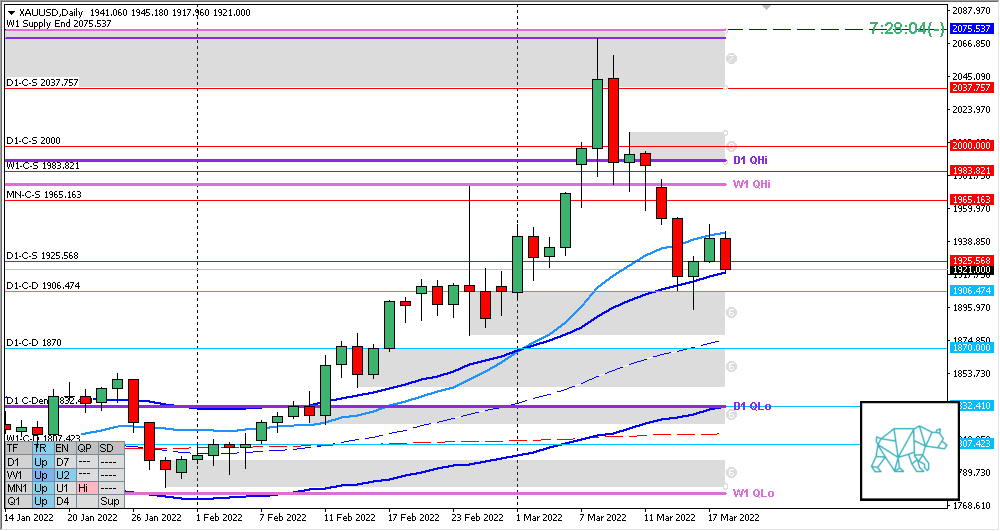

20 Mar Gold 2022 Week 12 Trading Plan

#Fintwit #Gold #XAUUSD #Orderflow #daytrading #daytrade #forex #FX #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife

This is my weekly outlook on GOLD. The levels that I will be looking at with a higher probabilistic chance the market will start reacting. During the session I then wait for the market to hit those levels and either confirm or reject my bias through price action confirmation and order flow. I hope that makes sense. If not, get in touch with me. I love to talk to people that are on the same path as me. So don’t be shy and reach out.

Monthly — Neutral

- MN closed as a RBR with some selling wick reacting off MN Supply and closing below MN QHi

- Price trading below MN-C‑S 1965.163 but still within MN QHi

- Price trading within last month’s range after having extended and made a HH

Weekly — Bearish

- W1 Evening Star reacting off W1-C‑S 1983.821 rejecting W1 QHi

Daily — Bearish

- D1 Three Outside Up to D1 VWAP

- D1 Bear Engulf closing within new demand giving D1-C‑S 1925.568 (possible D1 VWAP CAR) near its low

- D1 QHi rejected and price is trading mid swing

Sentiment summary — Bearish

- MN is still trading within last month’s upper range after seeing reaction off supply

- W1 Evening Star rejecting W1 QHi, although a retracement to newly formed C‑sup could negate a bearish thesis.

- D1 Broke down from VWAP and tested it closing down within newly formed demand. Although trading at D1 UKC in UT.

Additional notes

- Blackswan event could throw a wrench into a bearish outlook

Focus Points for trading development

- Monthly Goals

- No momentum trades on Non-Farm Fridays

- No early exits, either hit SL or target

- Use SL scaling in case the profit target for the setup doesn’t provide 2R for example for FA or VAA setups

- Risk Management

- 2 consecutive days of lack of sleep = NO TRADING

No Comments