16 Apr Gold 2022 Week 16 Trading Plan

#Fintwit #Gold #XAUUSD #Orderflow #daytrading #daytrade #forex #FX #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife

This is my weekly outlook on GOLD. The levels that I will be looking at with a higher probabilistic chance the market will start reacting. During the session I then wait for the market to hit those levels and either confirm or reject my bias through price action confirmation and order flow. I hope that makes sense. If not, get in touch with me. I love to talk to people that are on the same path as me. So don’t be shy and reach out.

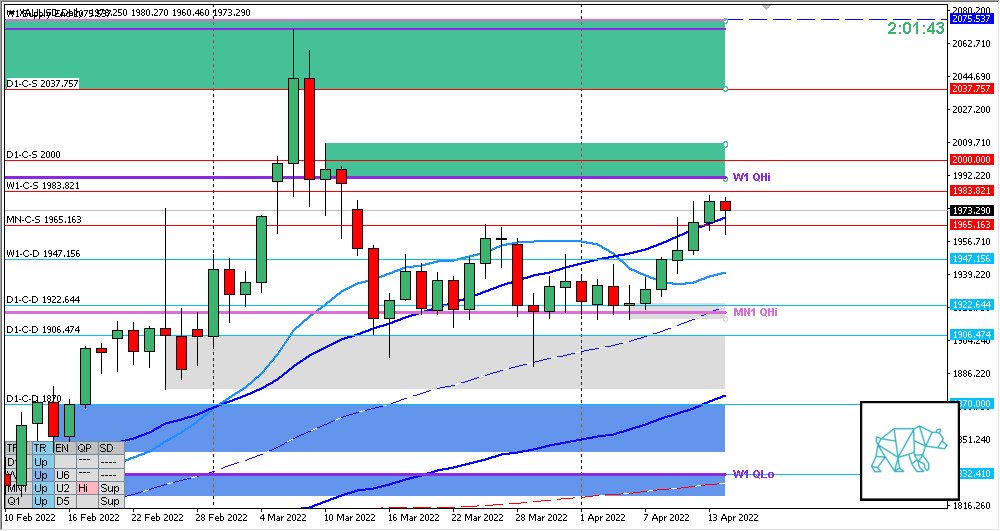

Monthly — Bullish

- Price made a HH and closed within MN QHi as an Inverted Hammer leaving a long selling wick reacting off and closing below MN-C‑S 1965.163

- Price is trading above last month’s body, but still within range

Weekly — Bullish

- W1 Consolidation and BO through W1 Three Outside Up giving W1-C‑D 1947.156

- Possible W1 Phase 1

- Price trading below W1 QHi after rejection

- Price closed near its high

Daily — Bullish

- D1 Phase 2

- D1 Base formed with longer buying wick

- Price trading below D1 QHi after QHi rejection

Sentiment summary — Bullish

- Price is trading higher within MN supply and is trading above previous month’s body although still within range. Be alert for possible sellers coming in.

- W1 QHi rejected but saw no follow-through. Instead a consolidation and break higher. Price has not (yet) closed within W1 Supply and due to the W1 Three Outside Momentum nature if price retraces to newly formed W1 demand it could signal a thesis for the opposite side ie. bearish sentiment.

- D1 is showing some slowdown although no reversal pattern (yet) and could see further follow-through higher.

Additional notes

- Blackswan event

- Easter Monday

Focus Points for trading development

- Monthly Goals

- No momentum trades on Non-Farm Fridays

- No early exits, either hit SL or target

- Use SL scaling in case the profit target for the setup doesn’t provide 2R for example for FA or VAA setups

- Risk Management

- 2 consecutive days of lack of sleep = NO TRADING

No Comments