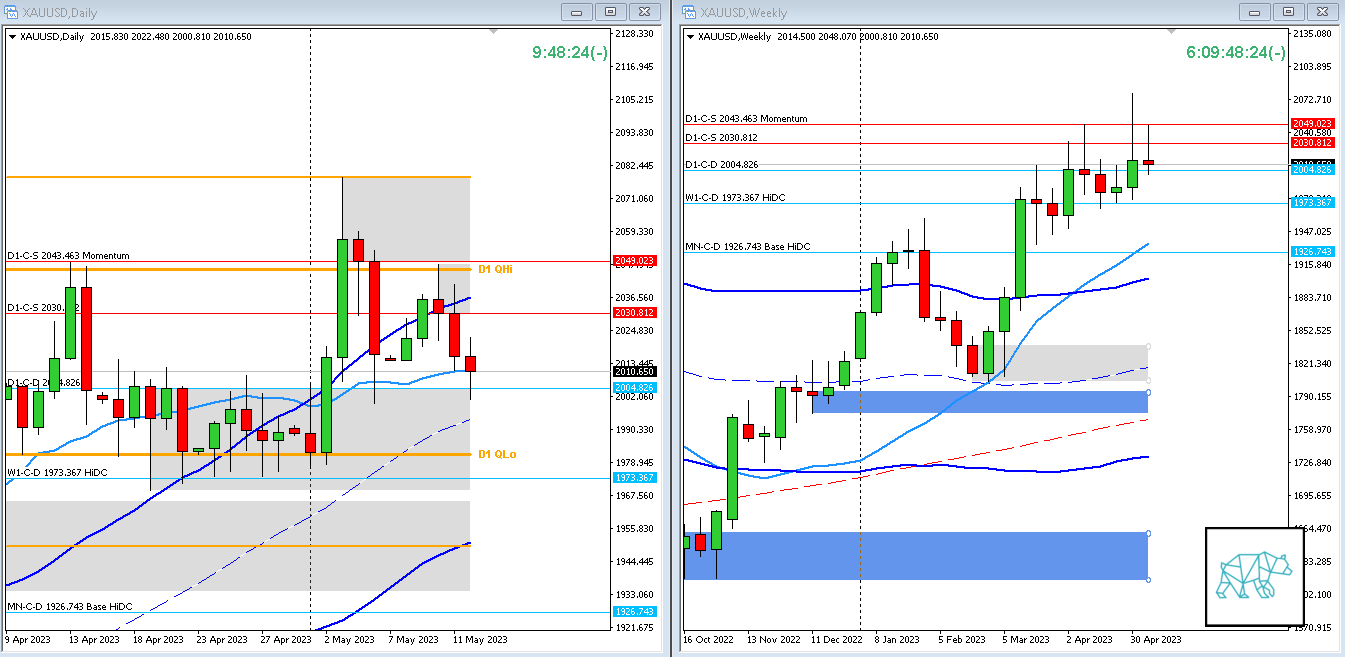

14 May Gold 2023 Week 20 Trading Plan

#Fintwit #XAUUSD #GOLD #MarketProfile #Orderflow #TradingPlan

This is my weekly outlook on GOLD. The levels that I will be looking at with a higher probabilistic chance the market will start reacting. During the session I then wait for the market to hit those levels and either confirm or reject my bias through price action confirmation and order flow. I hope that makes sense. If not, get in touch with me.

Monthly — Bullish

- Closed above previous structure high closing as an Inverted Hammer

- Price made a HH and took out Supply

- Conjecture: Inverted Hammer indicates possible sellers still being around although a continuation is more probable. Although having made a HH taking out Supply could see sellers come in.

Weekly — Neutral

- Price failed to make a HH instead price closed as a Spinning Top with longer selling wick

- Conjecture: Price closing as a Spinning Top could see a push down however it could still be a Base and potentially push higher.

Daily — Bearish

- D1 QHi rejected, followed by a test through D1 Three Outside Down giving D1-C‑S 2030.812 with slight continuation lower. Although price failed to close within. D1-C‑D 2004.826

- Possible D1 Phase 3

- Conjecture: A momentum move implies an immediate push lower. In absence of that price could push higher instead.

Sentiment summary — Neutral

Additional notes

- N.A.

Focus Points for trading development

- Monthly Goals

- Use SL scaling

No Comments