01 Feb Gold Week 5 Trading Plan

#Fintwit #Orderflow #daytrading #daytrade #forex #FX #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #Gold #XAUUSD

This is my weekly outlook on GOLD. Basically the levels that I will be looking at where it has a higher probabilistic chance the market will start reacting. During the session I then wait for the market to hit those levels and either confirm or reject my bias through price action confirmation and order flow through market profile. I hope that makes sense. If not, please get in touch with me. I love to talk to people that are on the same path as me. So don’t be shy and reach out.

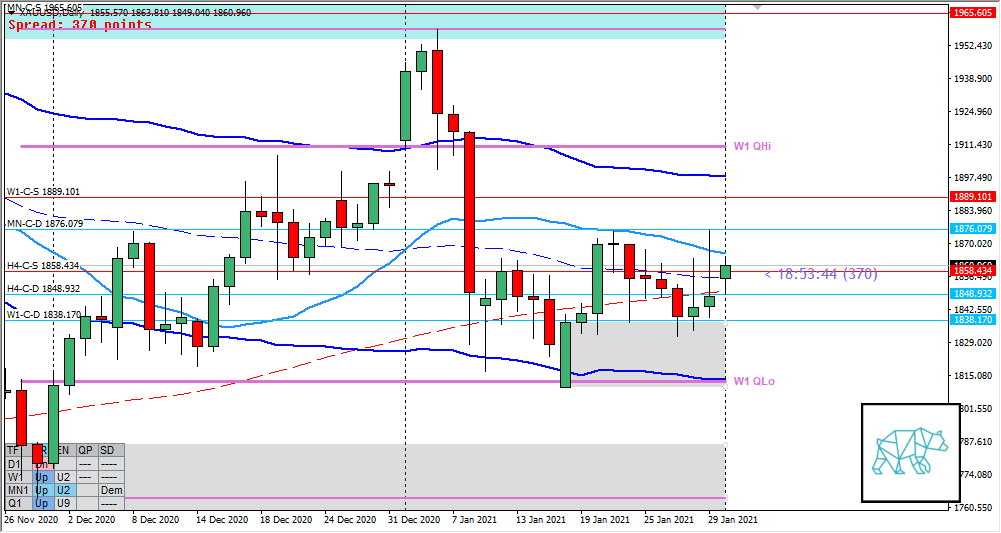

Monthly — Slightly Bearish

- MN-C‑D 1876.079 formed through Bull Engulf in December with no follow-through. Instead a test and reaction off MN-C‑S 1965.605 (2nd test, first in November). Month of January closing down within MN demand although not retracing more than 50%.

- Possible Phase 3

Weekly — Neutral

- W1 Bull Engulf at W1-C‑D 1838.170 with no follow-through. Instead a spinning top with slightly longer selling wick reacting off W1 VWAP CAR and nearby W1-C‑S 1889.101

- Possible W1 Phase 1 / 3

Daily — Neutral

- Possible D1 Phase 1 with price trading below VWAP in R, mid KC in R and W1 Q swing

H4 — Slightly Bullish

- H4 demand created at H4-C‑D 1848.932 with supply formed at H4-C‑S 1858.434 through Three Outside Down

- Possible Phase 1 / 3

Market Profile — Balancing

- Huge value created above previous 2‑day bracket

Sentiment summary — Neutral

- Due to larger time frame balancing (but still showing a UT) we would need to have a break from the overall range before determining a directional bias although there is a nod to the downside. Medium time frame confirms a non-committed directional market for the time-being.

Additional notes

- Friday: non-farm

ZOIs for Possible Shorts

- W1-C‑S 1889.101

- H4-C‑S 1858.434

ZOIs for Possible Long

- MN-C‑D 1876.079

- W1-C‑D 1838.170

Focus Points for trading development

- Monthly Goals

- Continue tracking my DRC tracking sheet

- Focus on my own progress and less on others

- Feeling okay with NOT trading

- Have ‘quieter’ weekends

- Weekly Goal

- Min. 3 times hitting the gym + mandatory cardio

- Trading Rules

- Trade from D and upwards unless a possible momentum trade, value acceptance or otherwise.

- Risk Management

- 3 trades 1% risk, 3rd trade only if first 2 worked out

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING

No Comments