18 Aug Premarket Prep GBPNZD 08182020

#premarketprep #tradingforex #forex #FX #daytrading #tradinglifestyle #daytraderlife #GBPNZD

This is my premarket prep for today’s European session for the Forex pair GBPNZD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias.

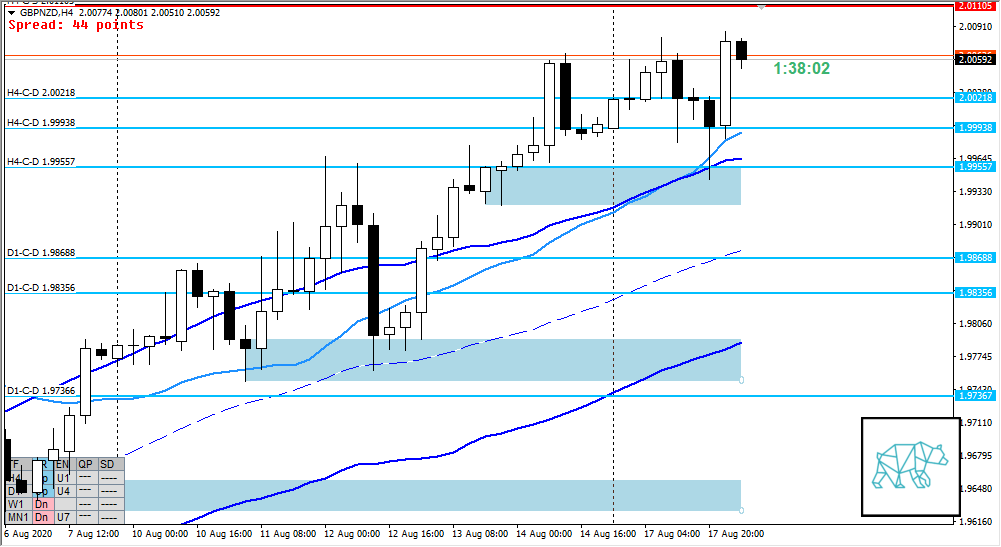

Non-conjecture observations of the market

- D1 weak near-bear engulf

- Previous H4 supply taken out, near arrive to H4-C‑S 2.01105

- Price still above H4 VWAP and UKC

- Possible H4 Phase 3 in effect

- H4 Bull Engulf formed new demand at H4-C‑D 2.00218 just above previous demand of H4-C‑D 1.99926

- Market Profile

- ADR 1323

- ASR 937

- 2nd day bracketing which seems to be the theme since last week. 2 days bracketing followed by a move up.

- Currently price is trading within value but need to reassess at LN open

- ADR 0.5 right above VAH

- ADR exhaustion short yesterday’s low

- H4-C‑D 2.00218 at yesterday’s range low

- H4-C‑D 1.99557 at ADR exhaustion below

- H4-C‑S 2.01105 at ADR exhaustion above

Compared against Weekly Trading Plan

- Mid MN, W1, and D1 swing

- W1 closed above VWAP, current candle above last week’s body

- H4, D1 trend is up, W1 is down

Sentiment — Neutral for now

- If LN opens below value within range (or even within value) we could see a move down since medium time frame is in a range and we are at the top of the range

- Open below within range would be most preferred here with price action confirming a possible break down from H4-C‑D 2.00218 although due to underlying demand ZOIs this could be a potentially agonizingly slow and risky play short

- An exhaustion to the top is a better location for a possible short with H4-C‑S 2.01105 right there

- A failed auction would be preferred

- Although since larger timeframe is still bullish need to be careful.

- Due to H4 and D1 being up in trend the safer play would be at H4-C‑D 1.99557 coinciding with ADR exhaustion

Additional notes

- N.A.

ZOIs for Possible Shorts

- H4-C‑S 2.01105

ZOIs for Possible Long

- H4-C‑D 2.00218

- H4-C‑D 1.99938

- H4-C‑D 1.99557

Mindful Trading

- Slept okay

Focus Points for trading development

- Weekly Goal

- Align with market narrative

- Taking a trade is not a priority

- Risk Management

- 3 trades 1% risk

- 2 consecutive days of lack of sleep = NO TRADING