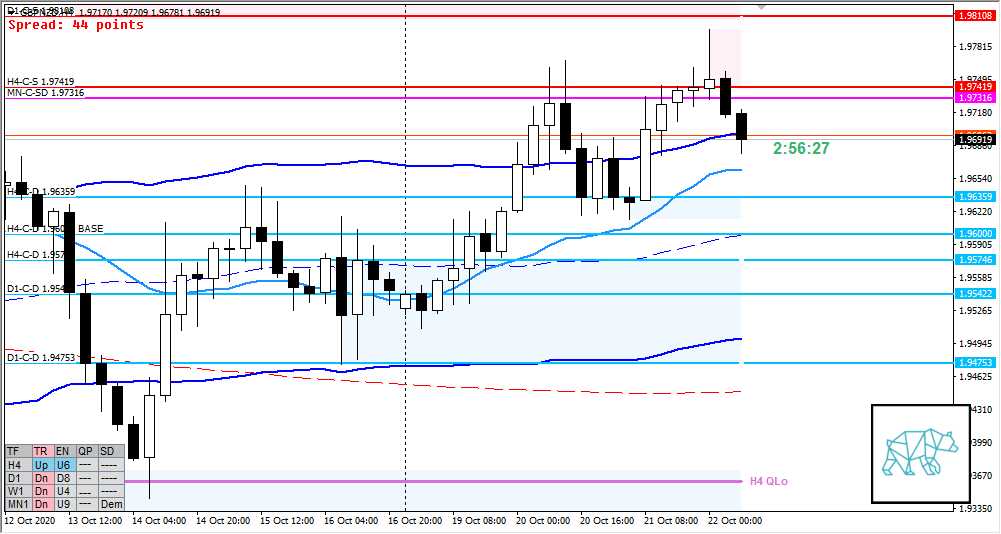

22 Oct Premarket Prep GBPNZD 10222020

#premarketprep #tradingforex #forex #FX #daytrading #tradinglifestyle #daytraderlife #GBPNZD

This is my premarket prep for today’s European session for the Forex pair GBPNZD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Weekly Focus Points

- Only trade off M30/M15 for entries. M30, time-based, or look for exits after 2 hours (4 TPOs). Unless the entry is really late.

Compared against Weekly Trading Plan

- Price trading above MN C‑Sup after having been tested multiple times

- W1 is trading above last week’s range with 2 more days to go

Non-conjecture observations of the market

- Price action

- D1 Phase 2 trading high reached UKC nearing 200MA and initial reach for D1-C‑S 1.98108 proven reactive

- Large Bull Engulf giving H4-C‑D 1.96359 phase 2, although not the cleanest move but traded higher still until reacting off D1-C‑S 1.98108.

- Market Profile

- Yesterday open below value followed by VAA and slow grind higher

- ADR: 1324

- ASR: 1129

- 29

- Day

- Yesterday’s High 1.97615

- Yesterday’s Low 1.96144

- Currently above value, outside range

Sentiment

- Locations

- D1-C‑S 1.98108 at ADR 0.5 high

- ADR 0.5 Low and Exhaustion at VAL

- H4-C‑D 1.96359 below VAL

- H4-C‑S 1.97419 at

- Sentiment

- LN open

- Within value, right below VAH

- Open distance to value

- N.A.

- Sentiment

- Balancing market, however the move was initiated from higher up after D1 C‑Sup proved reactive. Plus nelly formed H4-C‑S 1.97419.

- LN open

- Clarity (1–5, 5 being best)

- 2

- Hypo 1 — Swing Reversal (long),

- H4 C‑Dem, VWAP, ADR 0.5 & exhaustion low

- Preferred: Strong Bullish PA

- Hypo 2 — Value Rejection Failure (long)

- Same as hypo 1

- Preferred: IB extension down , PA reversal, failed auction

Additional notes

- N.A.

ZOIs for Possible Shorts

- D1-C‑S 1.98108

ZOIs for Possible Long

- D1-C‑D 1.95422

- H4-C‑D 1.96000 BASE

Mindful Trading

- Feeling a bit tired

Focus Points for trading development

- Monthly Goals

- Continue tracking my DRC tracking sheet

- Focus on my own progress and less on others

- Feeling okay with NOT trading

- Have ‘quieter’ weekends

- Weekly Goal

- Min. 3 times hitting the gym

- Trading Rules

- Trade from D and upwards unless a possible momentum trade, value acceptance or otherwise.

- Risk Management

- 3 trades 1% risk, 3rd trade only if first 2 worked out

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING