08 Dec Premarket Prep Gold 12082020

#fintwit #orderflow #daytrading #premarketprep #Forextrader #forex #FX #Forexlifestyle #daytrade #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #XAUUSD #GOLD

This is my premarket prep for today’s European session for GOLD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Weekly Focus Points

- Don’t take trades where SL placement is suboptimal. Instead, reassess for a better entry if possible.

Compared against Weekly Trading Plan

- Price trading above last week’s Inside Bar and is nearing W1-C‑S 1888.729 (still some ways to go)

Non-conjecture observations of the market

- Price action

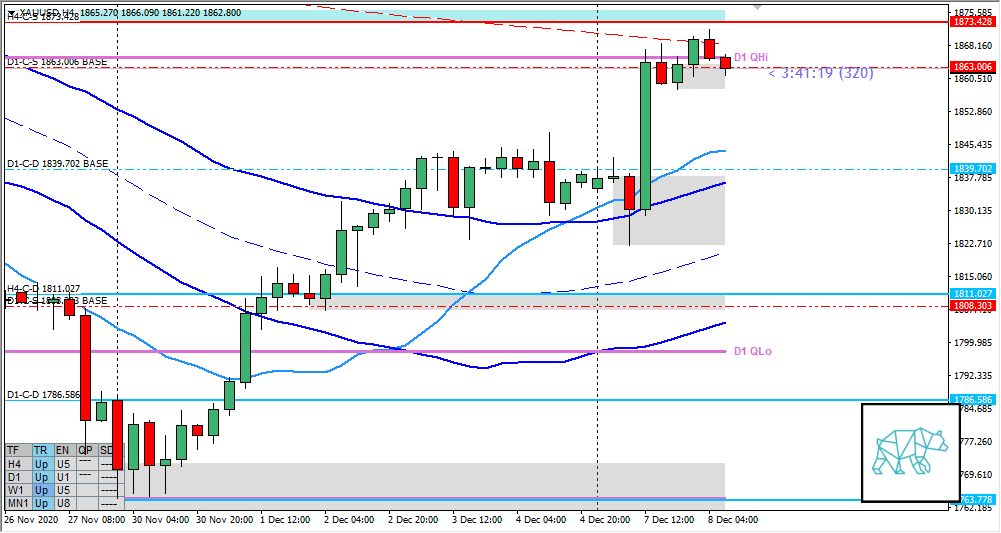

- D1 made a pullback and then closed making HHs completing a RBR giving D1-C‑D 1839.702 BASE. Price reached D1-C‑S 1863.006 BASE and is about to reach W1-C‑S 1877.471 BASE.

- Big H4 Bull Engulf formed at D1-C‑D 1839.702 BASE reaching for H4-C‑S 1873.428 and H4 200MA before consolidating and breaking consolidation to the upside.

- Market Profile

- Profiles in UT and then a 2 day bracketing

- ADR: 28150

- ASR: 18743

- 460

- Day

- Yesterday’s High 1848.085

- Yesterday’s Low 1829.079

Sentiment

- Locations

- D1-C‑D 1839.702 BASE near range high

- Sentiment

- LN open

- Above Value, Outside Range

- Open distance to value

- 1.7 xASR

- Sentiment

- Large Imbalance. Due to the large imbalance and Asia trading slightly higher I am more inclined for some mean reversion. ALthough, due to having reached a D1 Base level I do expect price sentiment to be more bullish. The consolidation at nearby H4 C‑sup would speak in favor of the mean reversion. A close deep into overhead supply would negate that but longing into supply is tricky to say the least. Don’t expect price to retrace all the way back to value due to D1-C‑D 1839.702 BASE being in the way and it would suggest more downside on the medium to long term.

- LN open

- Clarity (1–5, 5 being best)

- 4

- Hypo 1 — Mean Reversion

- Preferred: Taking out LTF supplies would take out H4 supply as well. IB extension down (momentum), sustained auction.

- Hypo 2 — Reactive Activity

- Hypo 3 — Trend Continuation

- Large imbalance might indicate ‘higher forces’ at play pushing prices higher.

- Preferred” Strong price action taking out LTF demand with IB extension up (momentum) sustained auction (possible low/medium initiative activity due to overhead supply.

Additional notes

- N.A.

ZOIs for Possible Shorts

- W1-C‑S 1888.729

- H4-C‑S 1873.428

ZOIs for Possible Long

- D1-C‑D 1839.702 BASE

Mindful Trading

- Feeling okay.

Focus Points for trading development

- Monthly Goals

- Continue tracking my DRC tracking sheet

- Focus on my own progress and less on others

- Feeling okay with NOT trading

- Have ‘quieter’ weekends

- Weekly Goal

- Min. 3 times hitting the gym

- Trading Rules

- Trade from D and upwards unless a possible momentum trade, value acceptance or otherwise.

- Risk Management

- 3 trades 1% risk, 3rd trade only if first 2 worked out

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING

No Comments