08 Mar Premarket Prep Gold 20210308

#fintwit #orderflow #daytrading #premarketprep #XAUUSD #GOLD #Forextrader #forex #FX #Forexlifestyle #daytrade #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife

This is my premarket prep for today’s European session for GOLD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Weekly Focus Points

- Only trade the main account

Compared against Weekly Trading Plan

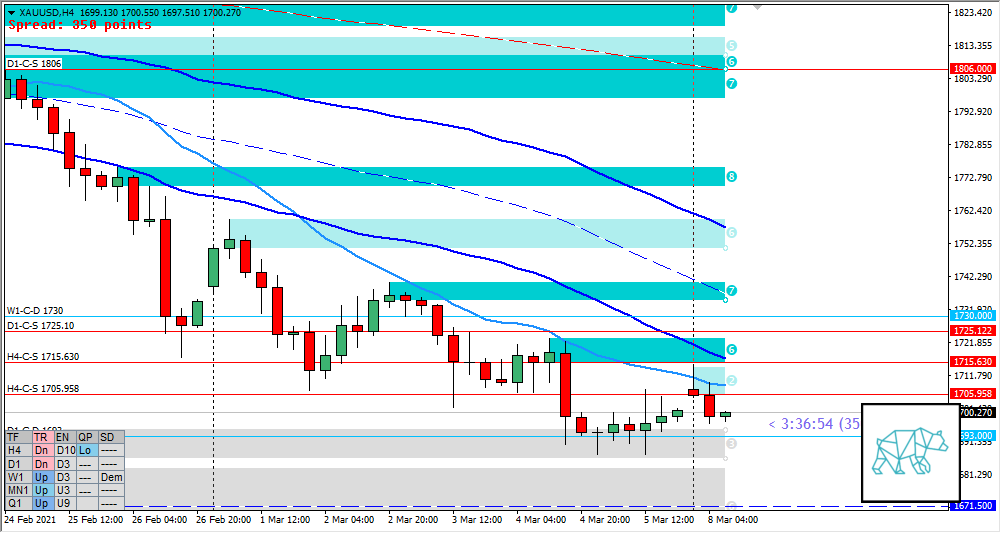

- Price is trading within W1-C‑D 1730

Non-conjecture observations of the market

- Price action

- Slight Gap up with gap fill

- Premarket H4 supply created at H4 VWAP in DT giving H4-C‑S 1705.958

- Trend

- Trend: H4 Down, D1 down, W1 up

- Market Profile

- Value in DT

- ADR: 31916

- ASR: 17995

- 450

- Day

- Yesterday’s High 1707.520

- Yesterday’s Low 1687.270

Sentiment

- Locations

- D1-C‑D 1693 at VAL

- Sentiment

- LN open

- Above Value, Within Range

- Open distance to value

- 0.1xASR

- Narrative

- Moderate Imbalance. With larger timeframe bearish sentiment we could see an acceptance of value also due to near proximity to value edge. Although an open above value does not entirely play into the larger timeframe sentiment so perhaps we could see a shift in sentiment although less likely on the short term.

- LN open

- Clarity (1–5, 5 being best)

- 4

- Hypo 1 — Value Accceptance

- Narrative: Open sentiment plus larger timeframe bearish sentiment.

- Preferred: Quick acceptance and rotation

- Con: LTF demand right at PPOC plus very tight value.

- Hypo 2 — Return to Value

- Narrative: Possible sentiment change, open above value, trading within W1 demand near D1 C‑dem.

- Preferred: Confident bullish price action with IB extension up and sustained auction.

- Con: Larger timeframe bearish sentiment.

Additional notes

- N.A.

ZOIs for Possible Shorts

- D1-C‑S 1725.10

- H4-C‑S 1715.630

- H4-C‑S 1705.958

ZOIs for Possible Long

- W1-C‑D 1730

- D1-C‑D 1693

Mindful Trading

- Feeling okay but a little tired

Focus Points for trading development

- Monthly Goals

- Continue tracking my DRC tracking sheet

- Focus on my own progress and less on others

- Feeling okay with NOT trading

- Have ‘quieter’ weekends

- Weekly Goal

- Min. 3 times hitting the gym

- Trading Rules

- Trade from D and upwards unless a possible momentum trade, value acceptance or otherwise.

- Risk Management

- 3 trades 1% risk, 3rd trade only if first 2 worked out

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING

No Comments