13 May Premarket Prep Gold 20210513

#fintwit #orderflow #daytrading #premarketprep #XAUUSD #GOLD #Forextrader #forex #FX #Forexlifestyle #daytrade #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife

This is my premarket prep for today’s European session for GOLD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Weekly Focus Points

- Min. 3 times hitting the gym + mandatory cardio

- Trading rules

- M15/M30 entries and exits at 1st DTTZ, M5 entries and exits at 2nd DTTZ

- Only price-action based exit rules (or if hit time stop comes earlier)

- Otherwise a Bart Simpson exercise

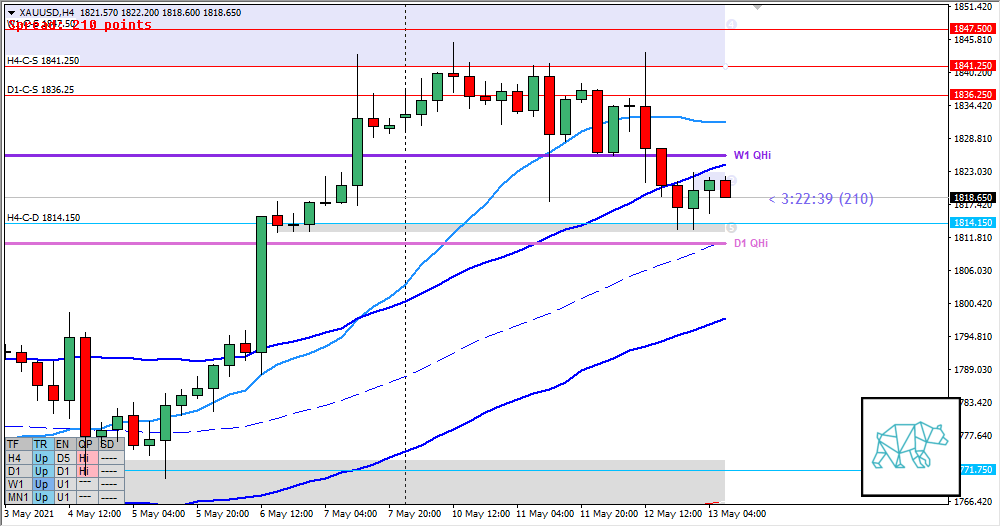

Compared against Weekly Trading Plan

- Price is reacting off W1-C‑S 1847.500

Non-conjecture observations of the market

- Price action

- D1 Bear Engulf reacting off D1-C‑S 1836.25 closing below W1 QHi (although still trading within D1 QHi)

- Price returned to H4-C‑D 1814.150 and started consolidating (above H4 50MA in UT although no touch)

- Trend: H4 Up, D1 Up, W1 Up

- Prevailing trend: Trend is up although having reached W1/D1 QHi there might be a reversal at hand. H4 phase 3 and break down further enhances this sentiment.

- Market Profile

- After 2‑day overlapping values yesterday’s value was created below further enhancing the reversal sentiment

- Daily Range

- ADR: 25423

- ASR: 15375

- 385

- Day

- Yesterday’s High 1843.540

- Yesterday’s Low 1813.180

Sentiment

- Locations

- Sentiment

- LN open

- Below Value, Outside Range

- Open distance to value

- 0.6xASR

- Premarket

- H4 Closed slightly higher as a Hammer possibly a pullback.

- Narrative

- Large Imbalance. With the open sentiment price could go either way. If price takes out H4 demand underneath there could be more downside in line with H4 Phase transition to 4.Franky Fake Out took it up and IB back down.

- LN open

- Clarity (1–5, 5 being best)

- 4

- Hypo 1 — Trend Continuation

- Narrative: Open sentiment, H4 Phase 3 to 4, D1 Bear Engulf

- Preferred: Strong Bearish PA, IB extension down

- Con: Small H4 demand in the way.

- Hypo 2 — Mean Reversion

- Narrative: H4 demand at H4 50MA in UT

- Preferred: Price traverses lower fulfilling mean reversion criteria, strong bullish PA to failed auction or IB extension up.

- Con: H4 phase 3 to 4 narrative

- Hypo 3 — Return to Value

- Narrative: Variation to Hypo 2

- Preferred: Price action moves higher to value edge before reversing with strong bearish PA, TPO structure or Single Print Fade.

- Con: LTF supply in the way

Additional notes

- Capital preservation rule in effect

- Might lose electricity today due to maintenance to power supply

ZOIs for Possible Shorts

- W1‑C‑S 1847.500

- H4-C‑S 1841.250

- D1‑C‑S 1836.250

ZOIs for Possible Long

- H4-C‑D 1814.150

Mindful Trading (lack of sleep?)

- Feeling okay

Focus Points for trading development

- Monthly Goals

- No momentum trades on Non-Farm Fridays

- Feeling okay with NOT trading

- Have ‘quieter’ weekends

- Weekly Goal

- Min. 3 times hitting the gym + mandatory cardio

- Trading rules

- M15/M30 entries and exits at 1st DTTZ, M5 entries and exits at 2nd DTTZ

- Only price-action based exit rules (or if hit time stop comes earlier)

- Otherwise a Bart Simpson exercise

- Risk Management

- Without forcing a trade: aim to take 1 trade a day, if possible 2.

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING

No Comments