18 May Premarket Prep Gold 20210518

#fintwit #orderflow #daytrading #premarketprep #XAUUSD #GOLD #Forextrader #forex #FX #Forexlifestyle #daytrade #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife

This is my premarket prep for today’s European session for GOLD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Weekly Focus Points

- Min. 3 times hitting the gym + mandatory cardio

- Trading rules

- M15/M30 entries and exits at 1st DTTZ, M5 entries and exits at 2nd DTTZ

- Only price-action based exit rules (or if hit time stop comes earlier)

- Otherwise a Bart Simpson exercise

Compared against Weekly Trading Plan

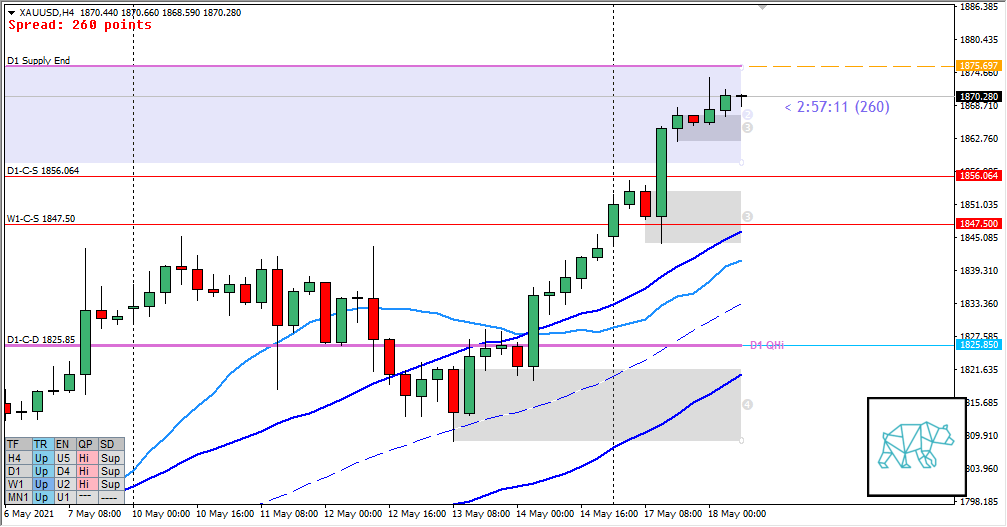

- Price trading above last week’s body and range nearing the end of supply

Non-conjecture observations of the market

- Price action

- Price traded higher and closed within D1-C‑S 1856.064 almost taking out supply and D1 QHi

- H4 price faltering at W1/D1 Supply End although still inching higher

- Trend: H4 Up, D1 Up, W1 Up

- Prevailing trend: Trend is Up

- Market Profile

- Value in UT

- Daily Range

- ADR: 24383

- ASR: 14661

- 370

- Day

- Yesterday’s High 1868.390

- Yesterday’s Low 1843.480

Sentiment

- Locations

- D1-C‑S 1856.064 at VAH

- Sentiment

- LN open

- Above Value, Outside Range

- Open distance to value

- 1.2xASR

- Premarket

- H4 traded higher within D1 supply

- Narrative

- Large Imbalance. Price is slowly inching higher although there is a large imbalance price could pop D1 supply and see a continuation to the move. Shorts are favored due to the large imbalance so there might be a mean reversion first.

- LN open

- Clarity (1–5, 5 being best)

- 4

- Hypo 1 — Mean Reversion

- Narrative: Open sentiment, trading within supply near End

- Preferred: Strong Bearish PA, IB extension down taking out LTF/H4 demand

- Con: There could be strength behind the move up

- Hypo 2 — Trend Continuation (Return to Value)

- Narrative: Possible strength behind the move, nearing D1 supply end

- Preferred: Strong Bullish PA, IB extension up or a failed auction in case of an extension down

- Con: Trading within Supply

Additional notes

- Capital preservation rule in effect

ZOIs for Possible Shorts

- D1-C‑S 1856.064

- W1-C‑S 1847.500

ZOIs for Possible Long

- D1-C‑D 1825.850

Mindful Trading (lack of sleep?)

- Feeling okay

Focus Points for trading development

- Monthly Goals

- No momentum trades on Non-Farm Fridays

- Feeling okay with NOT trading

- Have ‘quieter’ weekends

- Weekly Goal

- Min. 3 times hitting the gym + mandatory cardio

- Trading rules

- M15/M30 entries and exits at 1st DTTZ, M5 entries and exits at 2nd DTTZ

- Only price-action based exit rules (or if hit time stop comes earlier)

- Otherwise a Bart Simpson exercise

- Risk Management

- Without forcing a trade: aim to take 1 trade a day, if possible 2.

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING

No Comments