16 Jun Premarket Prep Gold 20210616

#fintwit #orderflow #daytrading #premarketprep #XAUUSD #GOLD #Forextrader #forex #FX #Forexlifestyle #daytrade #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife

This is my premarket prep for today’s European session for GOLD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Compared against Weekly Trading Plan

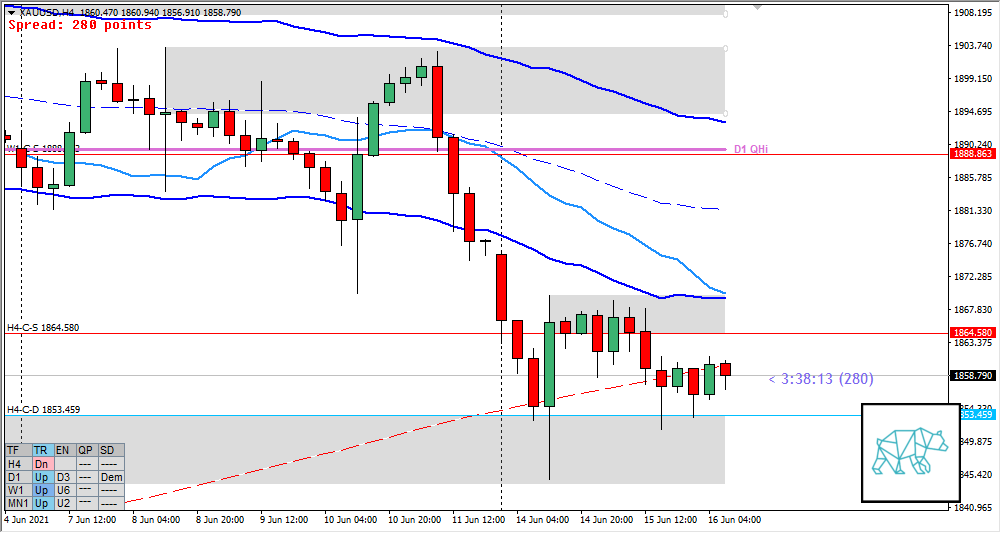

- Price trading below the range of the W1 Three Outside Down

Non-conjecture observations of the market

- Price action

- D1 closed lower within the preceding D1 Hammer’s range without making a LL trading deeper within D1 Demand

- Possible D1 Phase 4

- H4 broke lower from supply H4-C‑S 1864.580 arrival at OLD H4 demand and price started consolidating again. H4 Bull Engulf formed premarket.

- Trend: H4 Down, D1 Up, W1 Up

- Prevailing trend: Trend is UP 2/3

- Market Profile

- Value created above the previous

- Daily Range

- ADR: 24170

- ASR: 15725

- 393

- Day

- Yesterday’s High 1869.070

- Yesterday’s Low 1851.560

Sentiment

- LN open

- Below Value, Outside Range

- Open distance to value

- 0.16xASR

- Narrative

- Moderate to Large Imbalance.

- Clarity (1–5, 5 being best)

- 4

- Hypo 1

- Return to Value, probe of value, Failed Auction

- Hypo 2

- Return to value, VAL reversal, possible 2nd chance entry if no extension (although open sentiment might not favor it), monitor for sustained auction down

- Hypo 3

- Trend Continuation, sustained auction down, possible late sustained auction entry, possible target D1 QLo

- Hypo 4

- Auction Fade long, near D1 Demand End 1845, target IB low

Additional notes

- Capital preservation rule in effect

ZOIs for Possible Shorts

- W1-C‑S 1888.863

- H4-C‑S 1864.580

ZOIs for Possible Long

- H4-C‑D 1853.459 OLD

- D1-C‑D 1825.990

Mindful Trading (lack of sleep?)

- Feeling okay

Focus Points for trading development

- Monthly Goals

- No momentum trades on Non-Farm Fridays

- Total of 13 trades by the end of the month

- Weekly Goal

- Min. 3 times working out at home + mandatory cardio

- Risk Management

- Without forcing a trade: aim to take 1 trade a day, if possible 2.

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING

No Comments