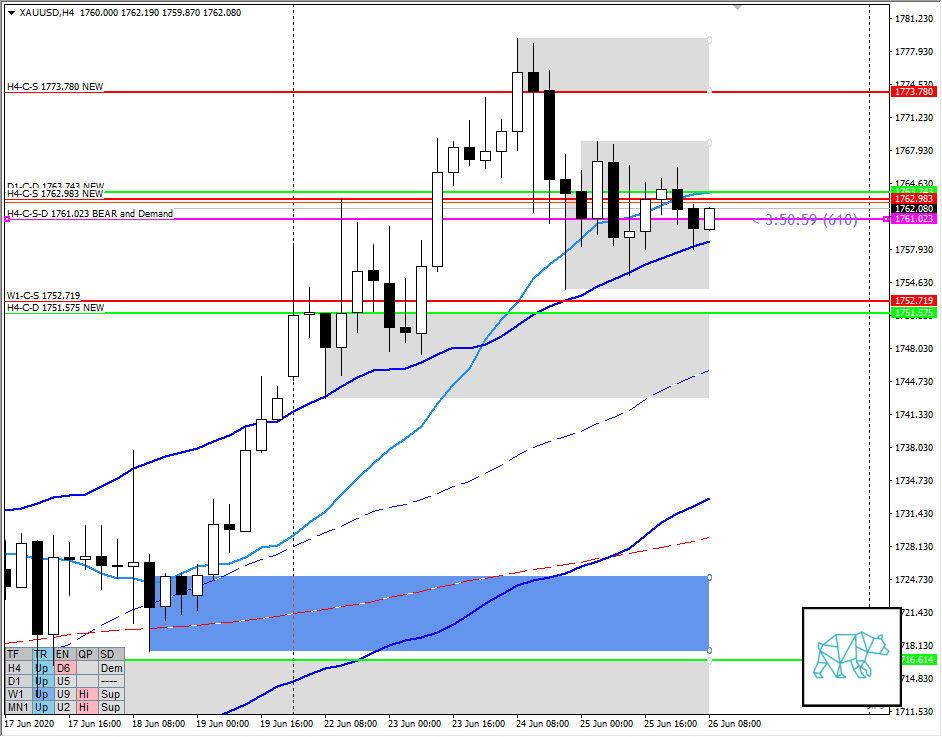

26 Jun Premarket Prep Gold XAUUSD 06262020

This is my premarket prep for today’s European session for Gold XAUUSD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias.

Non-conjecture observations of the market

- Yesterday closed as doji but still within consolidation range

- H4 Bear Engulf at D1-C‑S 1763.743 but no break away, instead price trading within bear engulf range at VWAP above UKC

- 2nd bear engulf at same level with c‑line H4-C‑S 1762.983 NEW

- H4 Bear Engulf c‑line H4-C‑S 1761.023 is also H4 demand H4-C-S‑D 1761.023

- Both supply and demand have been tested over and over

- Market Profile

- Currently price trading within value

Compared against Weekly Trading Plan

- Price still trading within Weekly supply

Sentiment — Neutral

ZOIs for Possible Shorts

- H4-C‑S 1773.780

- W1-C‑S 1752.719

- H4-C-S‑D 1761.023 BEAR and Demand

ZOIs for Possible Long

- H4-C-S‑D 1761.023 BEAR and Demand

- H4-C‑D 1751.575

Focus Points for trading development

- Risk Management

- Only take 2 trades a day but only have 1 active trade on between the assets

- Trading Priority

- FX pair outside value

- FX pair inside > Gold

- 2+R profit during LN consider trading PNYC

- After 4 losing trades reduce TP to 1.5R but after 1R can consider taking profits

No Comments