25 Jul WTI Crude Week 31 Trading Plan

#daytrade #daytrading #forex #FX #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife #GBPNZD #tradingforex #WTI #BLACKGOLD #CRUDEOIL #CRUDE #CRUDEOILISSLIPPERY #daytrading

This is my weekly outlook on WTI crude oil. Basically the levels that I will be looking at where it has a higher probabilistic chance the market will start reacting. During the session I then wait for the market to hit those levels and either confirm or reject my bias through price action confirmation and market profile. I hope that makes sense. If not, please get in touch with me. I love to talk to people that are on the same path as me.

Monthly — Slightly Bullish

- Developing month is trading above last month’s body but back within range after price made a new high taking out supplies

- Price trading within KC and hasn’t reached VWAP in an overall ranging market

- Still a lot that can happen in a week till candle close

Weekly — Slightly Bullish

- Price has been trading slowly above VWAP continuing incline and has re-entered KC

- New demand W1-C‑D 40.332 is formed through a consolidation with consequent weaker attempt to break higher

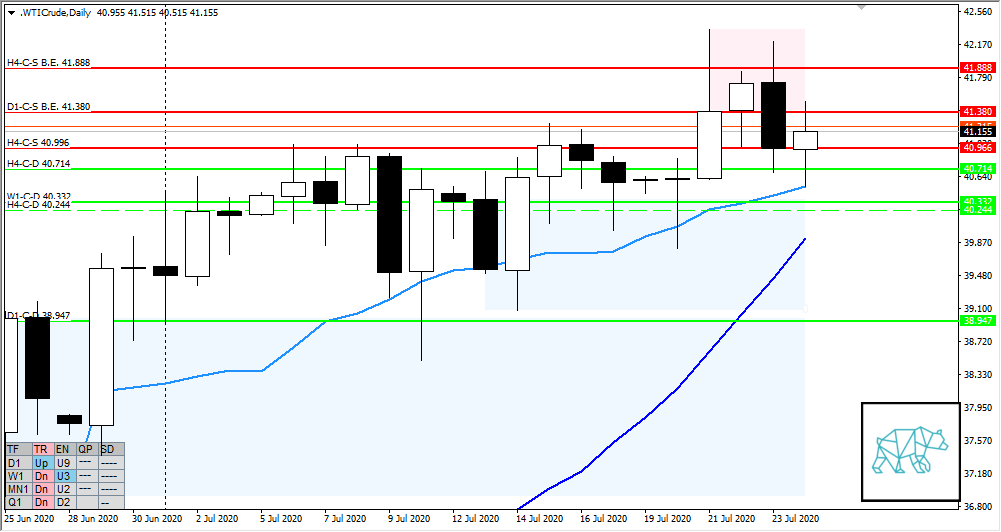

Daily — Neutral

- Multiple demand ZOIs formed on daily with D1-C‑D 35.727, D1-C‑D 38.947, and W1-C‑D 40.332 also being a daily demand zone

- Price traded away from the latter but wasn’t sustained and formed supply overhead through D1-C‑S B.E. 41.380

- No break away from the bear engulf though, instead price hovers above demand after testing overhead supply and could warrant more consolidation on the medium term

H4 — Slightly Bullish

- Demands made at H4-C‑D 40.244 and H4-C‑D 40.714 with a push up higher breaking from range to form a supply at H4-C‑S B.E. 41.888 no clean break away from supply, instead multiple tests after moving lower to H4-C‑D 40.714. Again unclean arrival here indicating possible phase 1 due to consolidation and bull engulf within consolidation.

- No push away from the bull engulf though, instead a continuation of the consolidation giving new supply H4-C‑S 40.996

- Longer buying wicks further suggesting a possible phase 1

Market Profile — Neutral to slightly bullish

- Multi-day bracketing with a slight dip below almost reaching M30 QLo followed by consequent move higher

- Last Friday was a P‑shaped profile day for London

Sentiment summary — Neutral to slightly bullish

- Larger time frames are looking bullish but price needs to break out of range to back this narrative up. Until such time anything could happen. As always, I will gauge intraday sentiment for more clues.

ZOIs for Possible Shorts

- D1-C‑S B.E. 41.380

- H4-C‑S B.E. 41.888

- H4-C‑S 40.996

ZOIs for Possible Long

- W1-C‑D 40.332

- D1-C‑D 38.947

- D1-C‑D 35.727

- H4-C‑D 40.244

Focus Points for trading development

- Weekly Goal

- Have correct SL placement and position sizing

- Due to summer time I will focus on trading off newly formed SD ZOIs for intraday plays. Keeping in mind that due to lack of liquidity 2nd chance entries can give better R/R using the M30/M15 rule.

- Risk Management

- Only take 2 trades a day but only have 1 active trade on between the assets

- Only trade off M30 candles

- Trading Priority

- FX pair outside value

- FX pair inside > Gold

- 2+R profit during LN consider trading PNYC

- After 4 losing trades reduce TP to 1.5R but after 1R can consider taking profits

- 2 consecutive days of lack of sleep = NO TRADING

No Comments