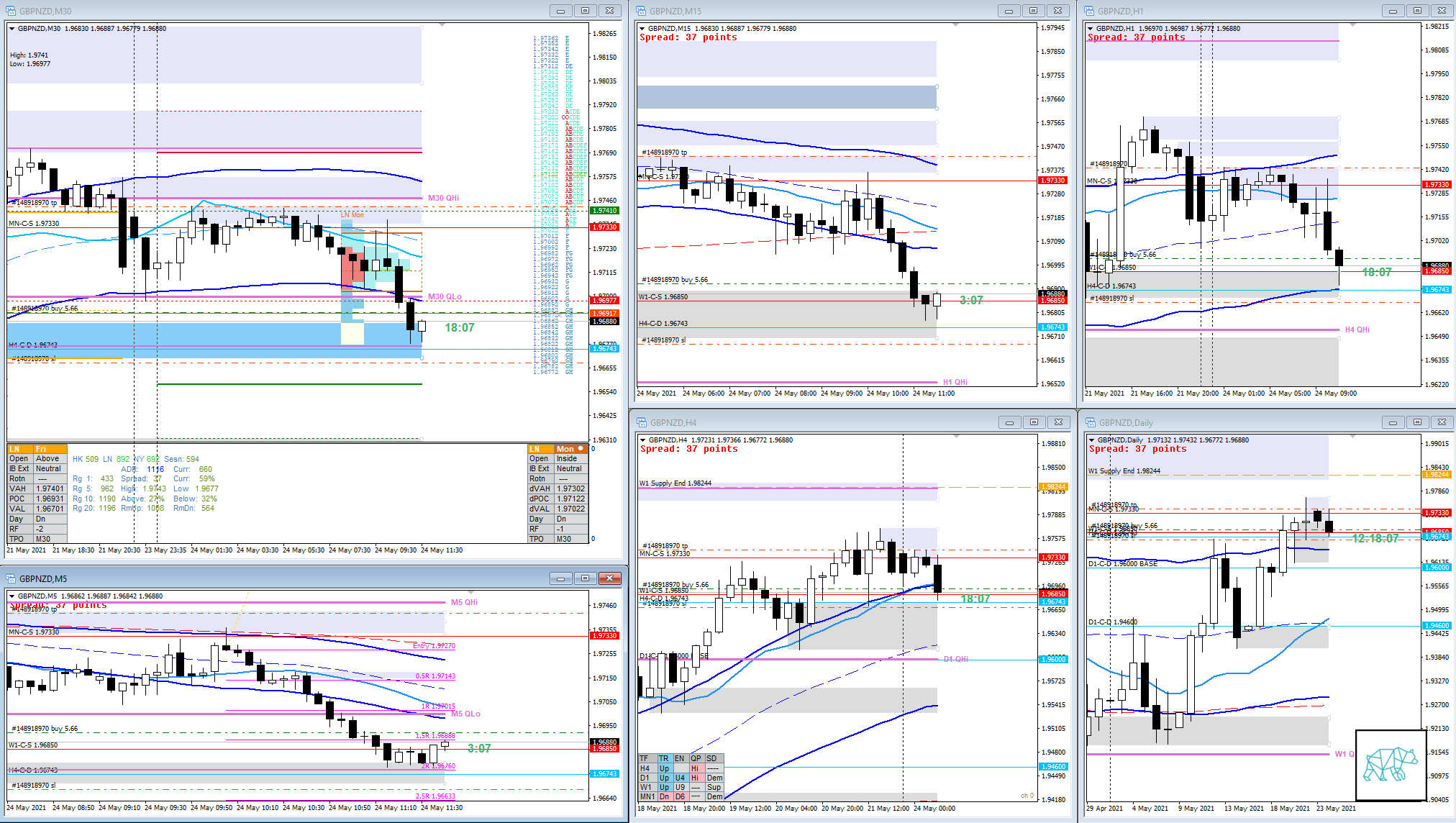

24 May 20210524 Trade Review GBPNZD

Play: Fading the Auction

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #GBPNZD

I have already reviewed these trades but I like to go back and review them again. Hence this new format I am introducing into my process.

Market Narrative

My trading idea was that after having formed a Neutral Day price reached H4 demand and started faltering on M5 and formed a Bull Engulf. Being a Neutral Day I hypothesized that there could be a chance for price to move back up to IBR instead of continuing the move down.

How was the Entry?

EDIT: So in Hindsight this was a bad trading idea. H4 Demand got popped and H4 candle was developing a bearish one breaking down from H4 VWAP in UT. Nevertheless, I think I did well to take a chance and perhaps get a buffer trade in.

I entered off the M5 Bull Engulf which was okay. Then I monitored for M15 to follow up with a positive transition into Three Inside Up after the Bullish Inside Bar which didn’t come. Instead there was a Doji which could form a base so let it go for a bit longer and then price formed a very flimsy M15 RBR so decided to extend the time a bit further visualizing a possible move to IB low and formation of a M30 Three Inside Up. Which did come (not the move to IB low but the M30 formation) but again very flimsy. This was part of the sustained auction move (after popping H4 demand seeing a pullback as a late-sustained auction entry opportunity).

Odds enhancer: Auction Fade, Neutral Day, H4 Demand Popped, 2 TPO Pullback,

How was the SL placement and sizing?

It was good as it was well below the formation and standard size.

How was the profit target?

I was banking on a buffer trade here and expecting to pocket 0.5R at IB low.

How was the Exit?

Exit was not great as price had just moved in my favor and I was expecting a continuation higher but I thought to pocket some profits due to trading in overlap noise as well as Profile showing another little structure before IB low (no single print fade).

What would a price action-based exit have done for the trade?

-0.2R

What would a time-based exit have done for the trade?

-0.2R

What did I do well?

I did really well to take the trade however risky it was. H4 demand got popped plus new H4 candle closed bearish breaking down from H4 VWAP in UT. Really longs were not favored in this setting. I did well to take the trade then commit to it for a while giving it some time to let it move. Then I took 0.2R profit prematurely for reasons outlined above but hey… progress not perfection.

What could I have done better?

With the Poor Low formed and H4 Demand Popped I could have gathered for a sustained move and taken the trade in the opposite direction for a late-sustained auction entry. Although this was very late into the session so don’t think I would have actually taken it.

Observations

2 TPO Pullback after H4 Demand Popped is something I forward-test.

Missed Opportunity

The aforementioned late-sustained auction entry

Premarket prep on the day

Daily Report Card on the day

No Comments