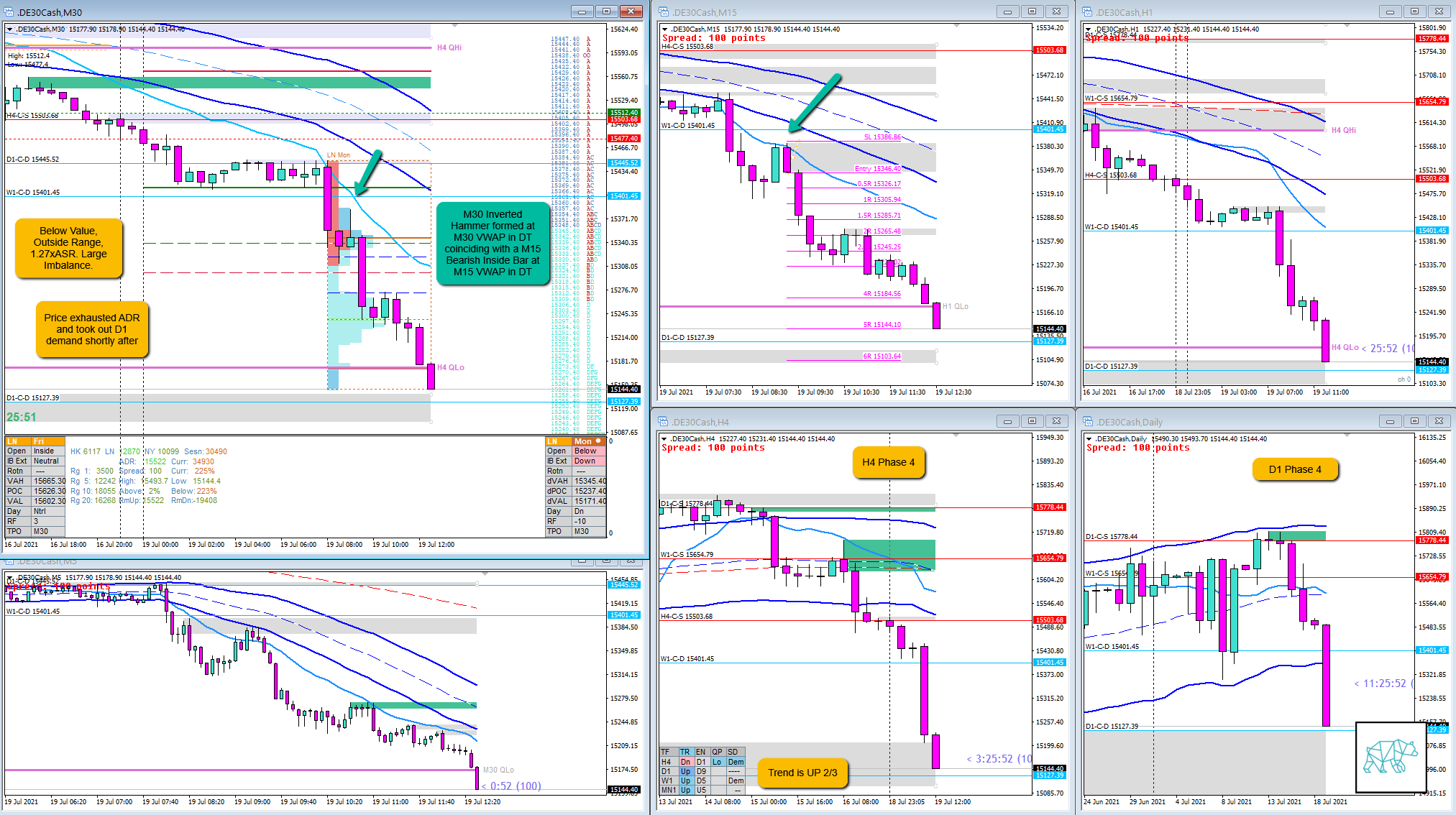

21 Jul 20210719 Missed Trade DAX

Play: Sustained Auction Weakness from within IBR

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #DAX #DE30 #DE30Cash #missedtrade

These are trades I could have taken but for some reason I did not. This could be due to me not paying attention or simply not feeling like trading. This is usually the case when I am not in the right state of mind due to lack of sleep, personal issues, etc.

Reason for missing the trade (explain the narrative)

I stalked the trade but I have not yet observed this opportunity that many times objectively. So I let the trade go and decided to document it as I am doing now.

What would have been the Entry?

Trade 1

DTTZ: 1st

Entry Method: M15 Bearish Inside Bar at M15 VWAP in DT

How was the SL placement and sizing?

Trade 1

SL placement: Slightly bigger than standard but managed to put it slightly above the formation.

How was the profit target?

Trade 1

Profit target: Expecting a sustained auction 2R was easily hit

What would a price action-based exit have done for the trade?

Trade 1

Exit: 2R would have been hit. 2R would have been on a M15 Bull Engulf as well.

What would a time-based exit have done for the trade?

Trade 1

Exit: 3R

TAGS: Trend is UP 2/3, D1 Phase 4, H4 Phase 4, Below Value, Outside Range, Large Imbalance, ADR exhaustion, D1 demand popped, Weakness from within IBR,

Extra Observations

N.A.

Premarket prep on the day

Daily Report Card on the day

No Comments