11 Aug 20210810 Missed Trade DAX

Play: Value Edge Reversal

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #DAX #DE30 #DE30Cash #missedtrade

These are trades I could have taken but for some reason I did not. This could be due to me not paying attention or simply not feeling like trading. This is usually the case when I am not in the right state of mind due to lack of sleep, personal issues, etc.

Reason for missing the trade (explain the narrative)

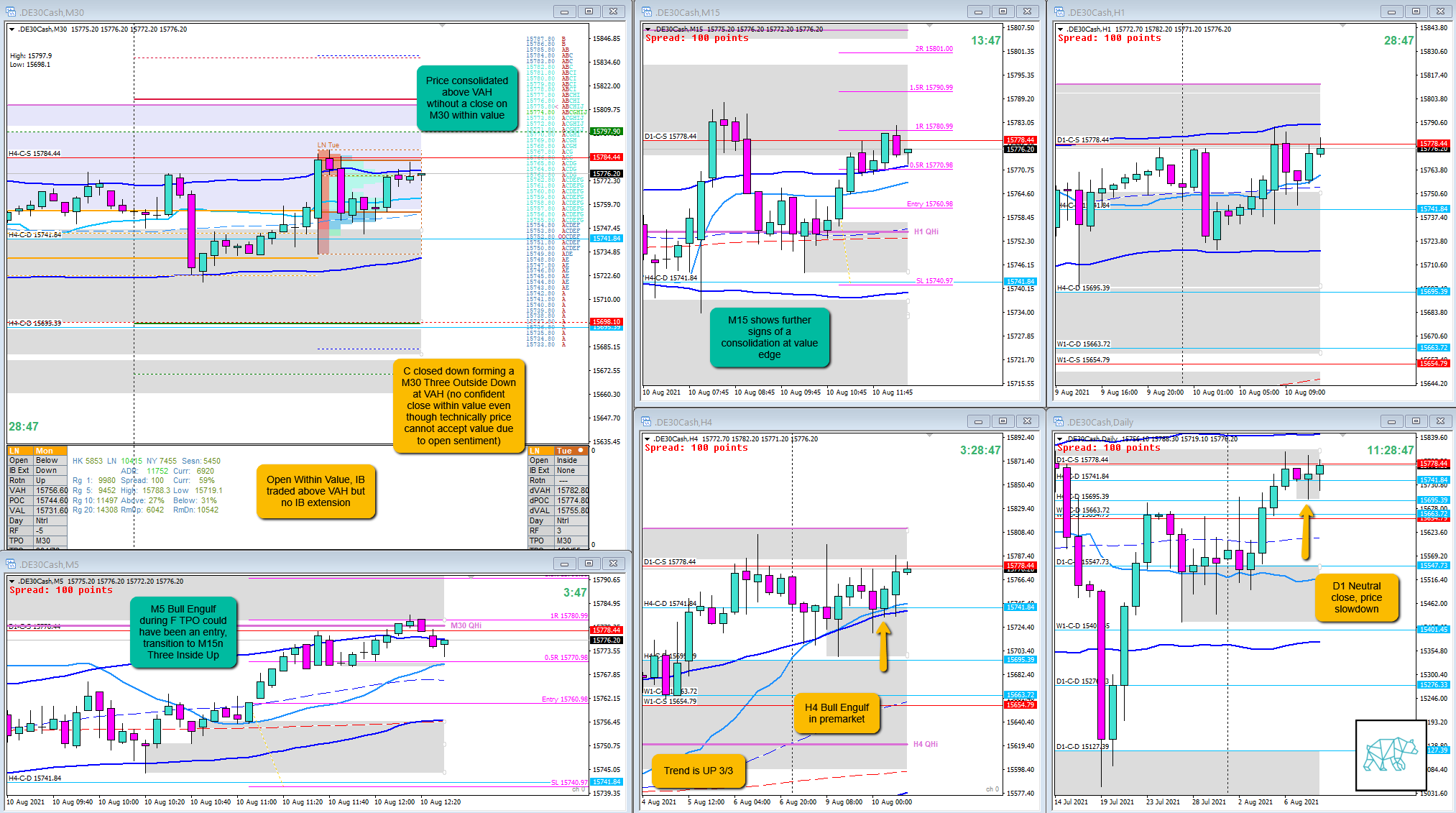

There was a D1 Neutral day the preceding day. H4 closed as a Bull Engulf although in premarket. There was an open inside value but the trend was up 3/3. Price traded above value during IB but never extended. Price pulled back to value edge and consolidated above VAH.

I was still feeling a bit off and I did not stalk the trade properly and went to do something else.

What would have been the Entry?

Trade 1

DTTZ: 2nd

Entry Method: M5 Bull Engulf, transition to M15 Three Inside Up, although an earlier entry could have been possible perhaps as well. Based off the M5 pinbar.

How was the SL placement and sizing?

Trade 1

SL placement: Scaled SL sizing below the M15 demand would have sufficed.

How was the profit target?

Trade 1

Profit target: 1.4 at IB high although expectancy was for a possible slow move higher although being late into the session as well as trading during August a more conservative of 1R would have been okay.

What would a price action-based exit have done for the trade?

Trade 1

Exit: 0.4R off the potential M15 Bearish Inside Bar

What would a time-based exit have done for the trade?

Trade 1

Exit: 0.6R, 0.7R in overlap noise after going to 1R

TAGS: Trend is UP 3/3, Open Within Value, Value Edge Reversal,

Extra Observations

A consolidation at value edge without a close within value (regardless of open sentiment) can indicate a bounce in the outward direction.

Premarket prep on the day

Daily Report Card on the day

No Comments