20 Aug 20210819 Missed Trade DAX

Play: Sustained Auction, Late-Sustained Auction Entry

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #DAX #DE30 #DE30Cash #missedtrade

These are trades I could have taken but for some reason I did not. This could be due to me not paying attention or simply not feeling like trading. This is usually the case when I am not in the right state of mind due to lack of sleep, personal issues, etc.

Reason for missing the trade (explain the narrative)

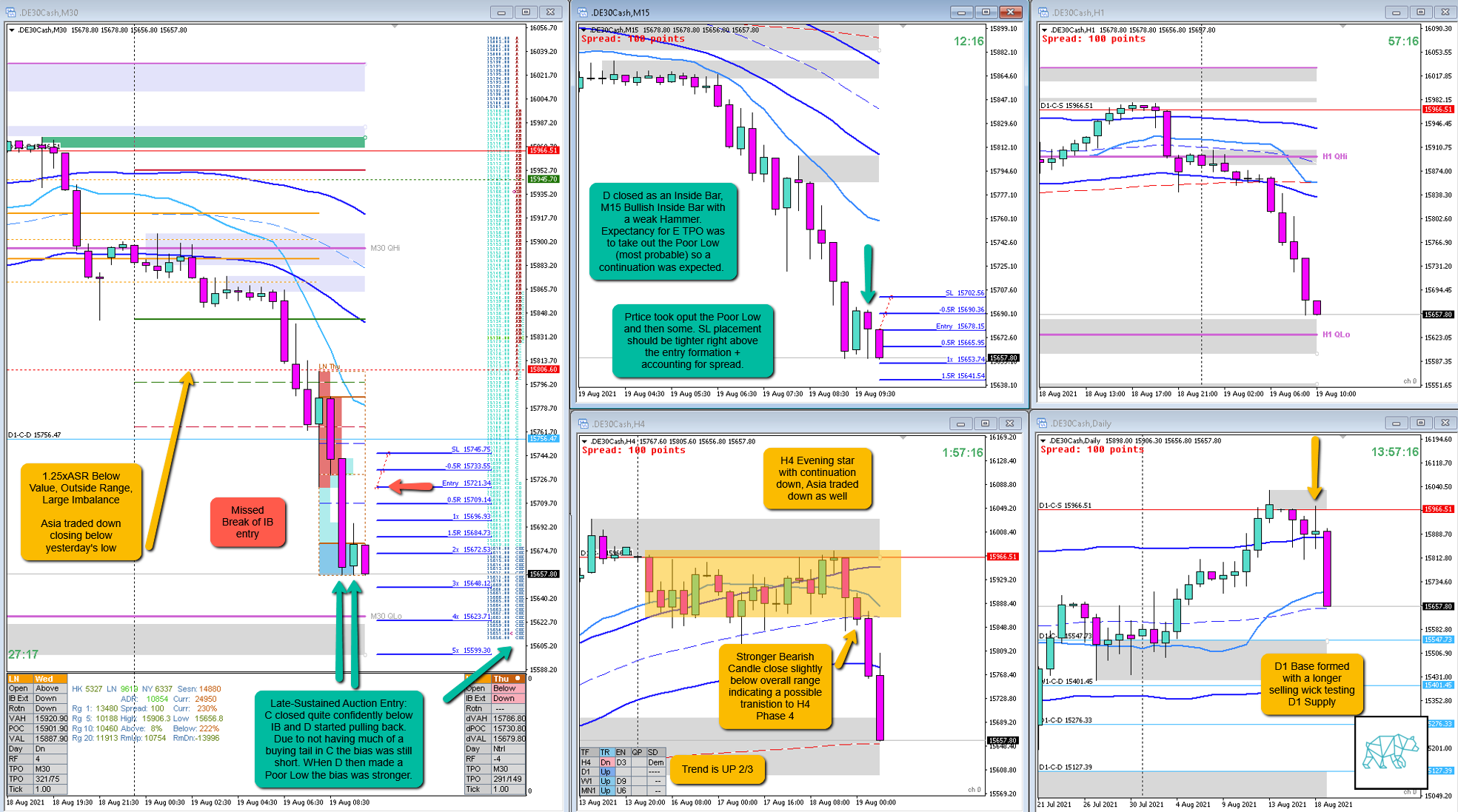

There was a D1 base formed with a selling wick testing D1 supply. H4 looked to be transitioning into H4 Phase 4 due to a close slightly below the overall range. Open 1.25xASR below value, outside of range, large imbalance usually means a mean reversion. When C extended strongly below I gathered a sustained auction or unidirectional day was more likely.

I didn’t know at the time that the big boys are settling accounts before the ECB rate decision causing a sell off which they call a Risk-Off day.

I missed the break off IB entry due to not being at my desk. I wasn’t home yet.

The late-sustained auction entry I simply hesitated. I could have gone for it as it is something I have observed before.

What hypo was it?

Hypo 1

Sustained Auction Down, IBR wide, possible entry on weakness from within IBR to join the auction, or late-sustained auction entry

What would have been the Entry?

Trade 1

DTTZ: 1st

Entry Method: I was considering to go short on the M15 Bullish Inside Bar thinking that the Poor Low that was formed was more likely to get taken out.

C closed Bearish and D had not left a selling tail in C so the sentiment was still bearish at the time. Price then made a Poor Low with C and D where the profile had a 2 print low (ie no tail at all). The expectation was for E TPO to at least take out the low not necessarily have much of a continuation.

Entry could have been off the close of the M15 Hammer.

How was the SL placement and sizing?

Trade 1

SL placement: SL could have been tighter right above the M15 entry formation.

How was the profit target?

Trade 1

Profit target: 0.9R at Poor Low, if I would use a better SL placement this would have been 1.2–1.4R, trade eventually went much further 2+R

What would a price action-based exit have done for the trade?

Trade 1

Exit: 2R

What would a time-based exit have done for the trade?

Trade 1

Exit: 2R would have been hit otherwise ‑1R

TAGS: Below Value, Outside Range, Large Imbalance, Poor Low, Trend is UP 2/3,

Extra Observations

Risk-Off Day: big boys moving cash from equities to bonds due to upcoming rate decision from ECB. Some correction is to be expected. Perfectly normal ahead of any potential rate changes.

Premarket prep on the day

Daily Report Card on the day

No Comments