21 Aug 20210820 Missed Trade DAX T1

Play: Strength From Within IBR

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #DAX #DE30 #DE30Cash #missedtrade

These are trades I could have taken but for some reason I did not. This could be due to me not paying attention or simply not feeling like trading. This is usually the case when I am not in the right state of mind due to lack of sleep, personal issues, etc.

Reason for missing the trade (explain the narrative)

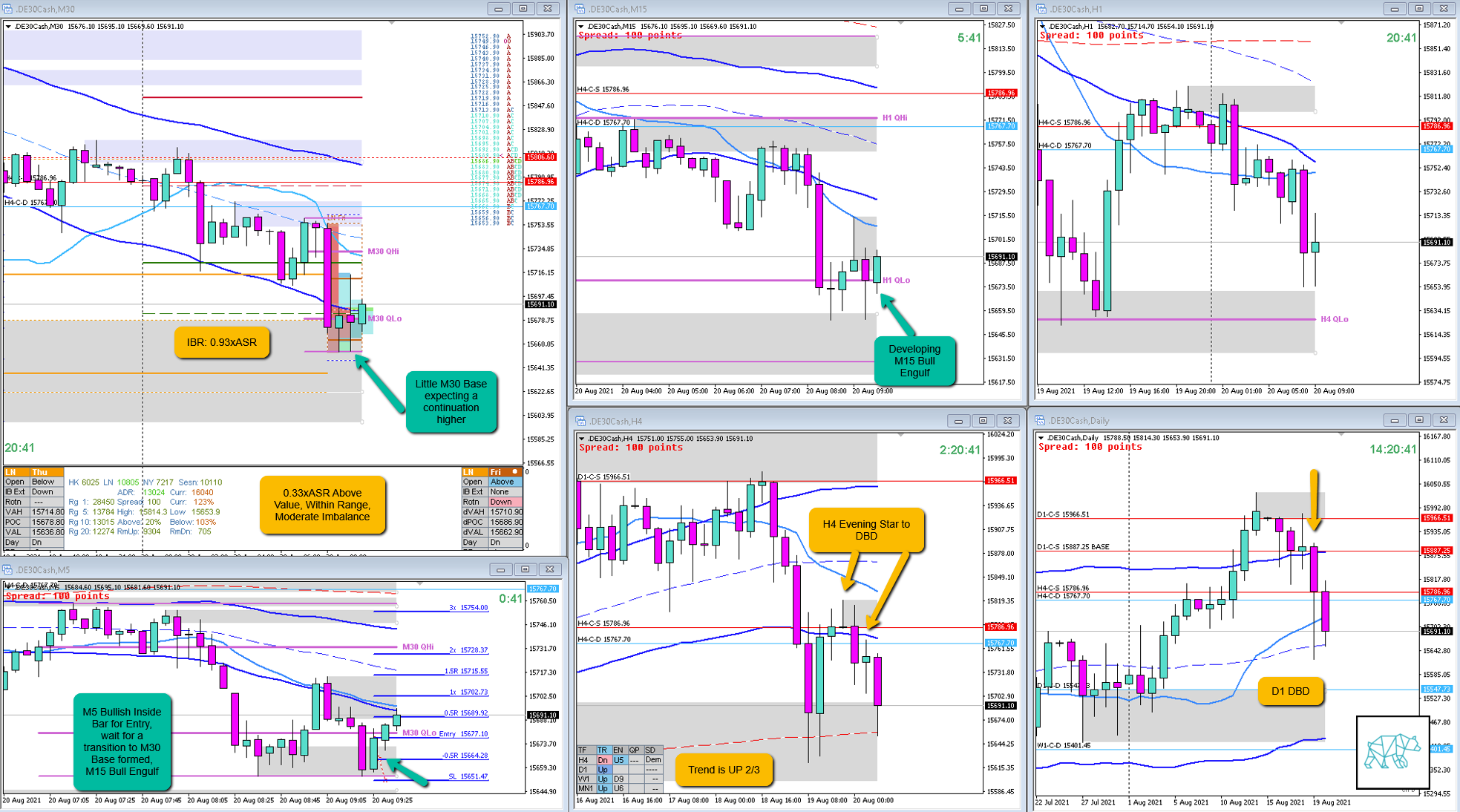

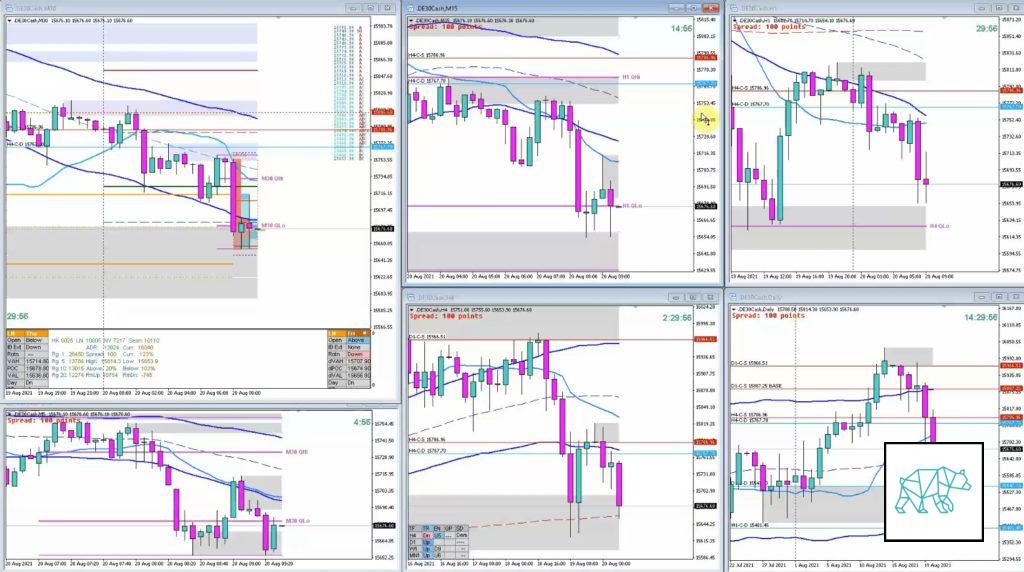

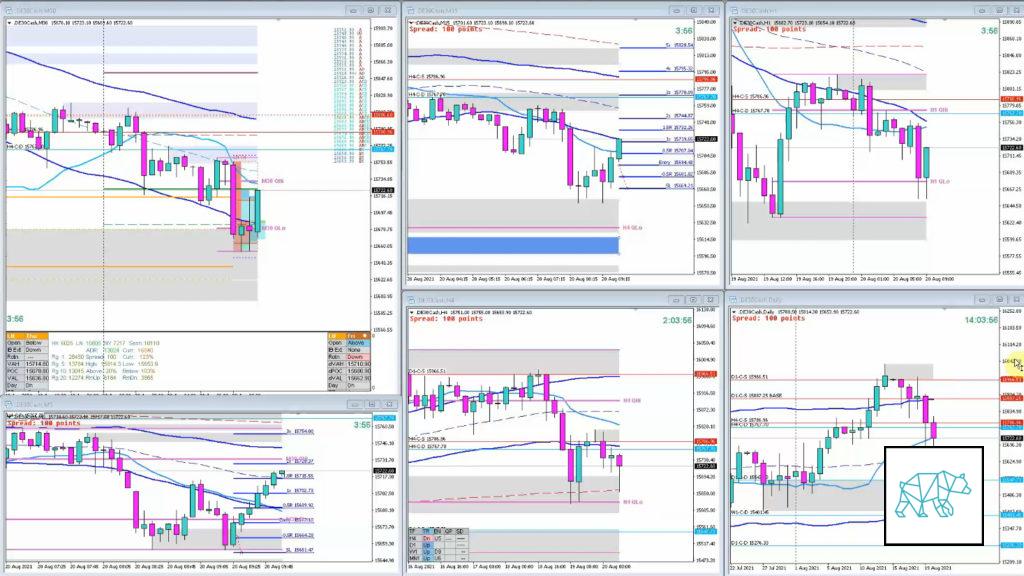

There was a D1 DBD the day before. H4, even though forming a Bull Engulf, showed no continuation higher to the move. Instead there was an Evening Star and formed a Base in premarket. The expectation is for a H4 DBD to form ie. today’s session will trade and close lower. Although within the 4‑hour formation of the candle there can be an expansion ie. making a LL followed by a contraction ie. pullback, followed by another expansion till the close. This latter I will get to in a T2 post of missed trade review later on.

Price had opened above value and proceeded to accept value in A (traversing 0.93xASR during IB indicating responsive activity). With trend being up 2/3, open sentiment, LTF demand at VAL, as well as DAX being equities the bias was for a reaction higher. There was also a nearby W1 demand.

I kinda expected a Failed Auction to be forming but when I noticed price had just tested IB low and started reacting I was late to the party. I hoped for a pullback to catch an entry long but due to price trading higher I could not find an entry that would fit my max SL placement.

What hypo was it?

Hypo 1

Return to Value, Strength from within IBR to go Long

Nailed it on the Hypo

What would have been the Entry?

Trade 1

DTTZ: 1st

Entry Method: M5 Bull Engulf formed on a test of IB low during C TPO.

How was the SL placement and sizing?

Trade 1

SL placement: about standard SL sizing, slightly tighter

How was the profit target?

Trade 1

Profit target: 2+R

What would a price action-based exit have done for the trade?

Trade 1

Exit: 2R

What would a time-based exit have done for the trade?

Trade 1

Exit: 2R target was reached, if not taken then it would have closed at scratch 0R

TAGS: Trend is UP 2/3, Above Value, Within Range, Moderate Imbalance,

Extra Observations

The next review (Missed Trade DAX T2) will incorporate the thesis outlined above in further detail.

Premarket prep on the day

Daily Report Card on the day

No Comments