21 Aug 20210820 Missed Trade DAX T2

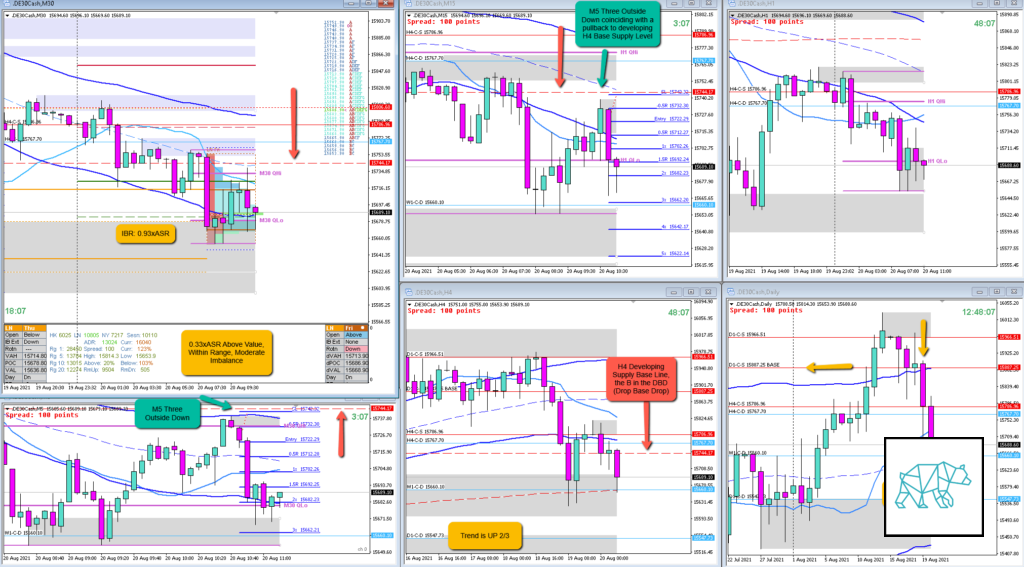

Play: Weakness From Within IBR, Developing H4 DBD narrative

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #DAX #DE30 #DE30Cash #missedtrade

These are trades I could have taken but for some reason I did not. This could be due to me not paying attention or simply not feeling like trading. This is usually the case when I am not in the right state of mind due to lack of sleep, personal issues, etc.

Reason for missing the trade (explain the narrative)

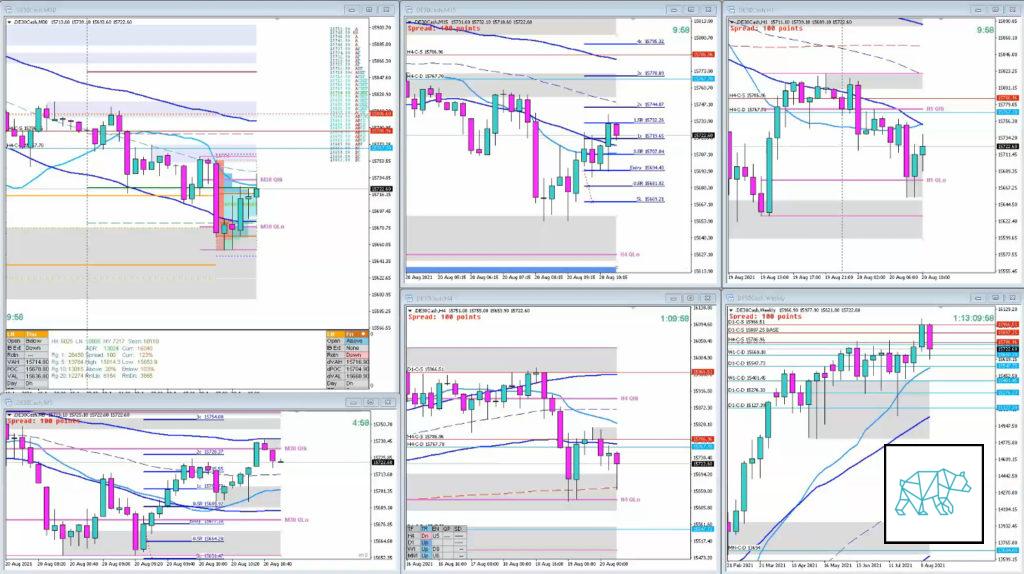

There was a D1 DBD the day before. H4, even though forming a Bull Engulf, showed no continuation higher to the move. Instead there was an Evening Star and formed a Base following a Drop in premarket. The expectation is for a H4 DBD (Drop Base Drop) to form ie. today’s session will trade and close lower. Although within the 4‑hour formation of the candle there can be an expansion ie. making a LL followed by a contraction ie. pullback, followed by another expansion till the close. Like a breathing motion 🙂

Price had opened above value and proceeded to accept value in A (traversing 0.93xASR during IB indicating responsive activity). With trend being up 2/3, open sentiment, LTF demand at VAL, as well as DAX being equities the bias was for a reaction higher. There was also a nearby W1 demand.

After the initial contraction to the developing H4 DBD supply conterminous line (base) as outlined in T1 in the earlier post. It was more likely for price to close lower than it was to close above this developing supply line.

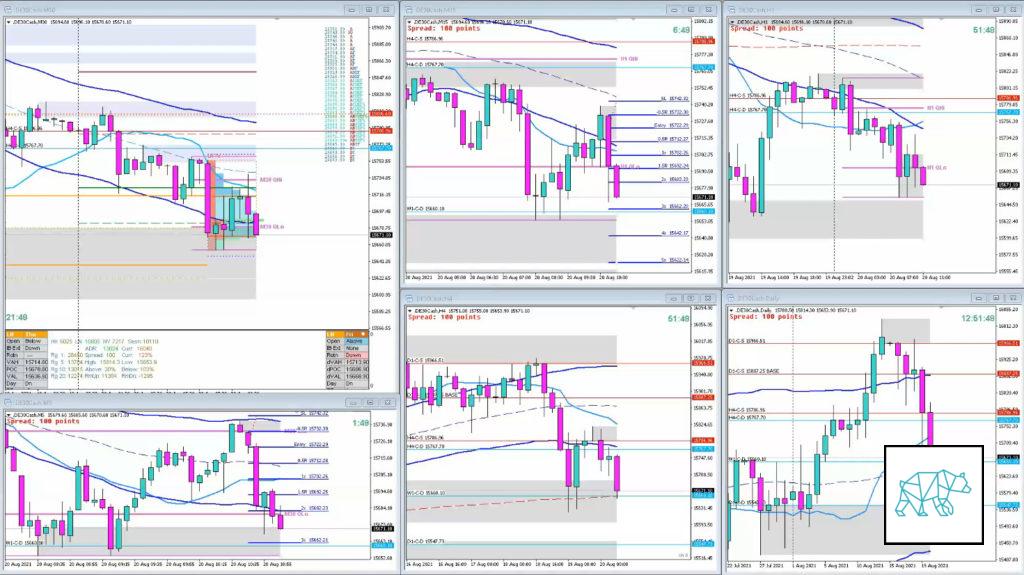

This move came during 2nd DTTZ and was quite quick as moves often do during 2nd DTTZ in DAX.

What hypo was it?

I had not written a Hypo for it but will include it later. I did not want to include a contrary move to the overall thesis but next time I will.

What would have been the Entry?

Trade 1

DTTZ: 2nd

Entry Method: M5 Three Outside Down on a pullback to developing H4 Base Supply level coinciding with M30 QHi and M30 VWAP in DT.

How was the SL placement and sizing?

Trade 1

SL placement: Tighter SL would be allowed just above the M5 formation because if price would take out that formation the thesis would be negated.

How was the profit target?

Trade 1

Profit target: 2R at M30 QLo.

What would a price action-based exit have done for the trade?

Trade 1

Exit: 2R

What would a time-based exit have done for the trade?

Trade 1

Exit: 2R target would have been hit overruling the time-based exit. Otherwise it would have been 1.1R

TAGS: Trend is UP 2/3, Above Value, Within Range, Moderate Imbalance, Developing H4 DBD,

Extra Observations

N.A.

Premarket prep on the day

Daily Report Card on the day

No Comments