27 Aug 20210825 Trade Review DAX

Play: Auction Fade

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #DAX #DE30 #DE30Cash

Market Narrative

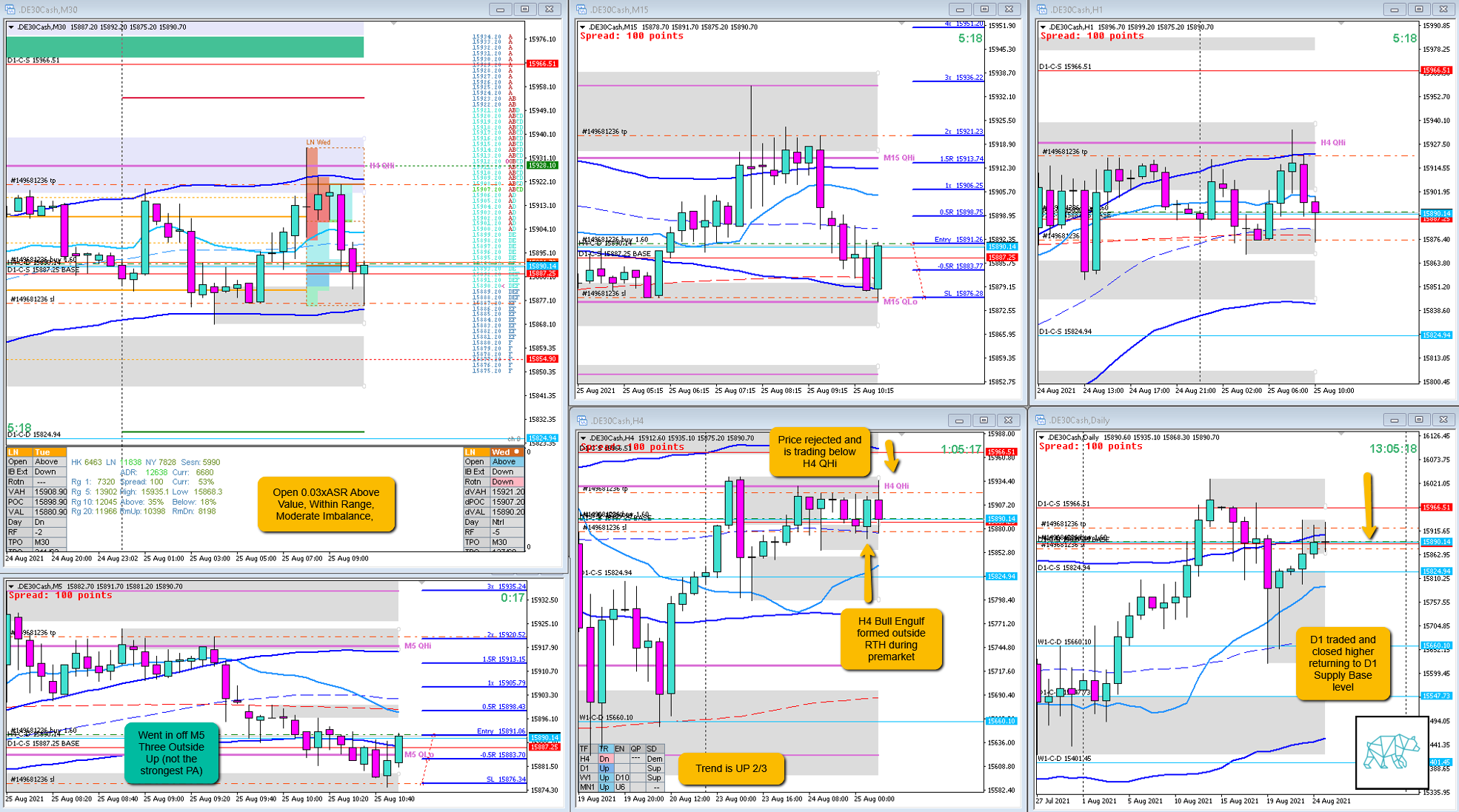

D1 had traded and closed higher returning to D1 Supply base level indicating a possibility to continue higher to the originating level at D1-C‑S 15966.51.

A H4 Bull Engulf was formed but outside of RTH in premarket. Trend is up 2/3. Open 0.03xASR above value, within range indicating moderate imbalance.

Price proceeded to accept value and extend to the downside in a sustained move rotating through value.

What hypo was it?

Hypo 2

Auction Fade Long, variation to hypo 3

I gathered with newly formed H4 demand (made outside of RTH) nearby plus coupled with the right time of day there could be a bounce from this level.

How was the Entry?

Entry was off a M5 Three Inside Up which I wanted to transition into a Bullish M15 candle which did not come. Instead an inside bar with longer selling wick was formed. Selling wicks not entirely trustworthy in DAX I decided to stick with the trade thinking the trading location was good. This was not.

How was the SL placement and sizing?

Good just below the M5 entry although slightly cutting so had to adjust this a little but still within the margin of error on SL placement ie. +- 1%

How was the profit target?

This is where I went wrong. I still, for some reason, had in my head I can let the trade go to IB low and then wait for a Failed Auction to continue higher expecting great R‑multiples in return. However, with an Auction Fade the target is IB low. Here IB low proved to have a subpar profit margin and thus the whole setup should not have been taken. This, and that value had been rotated first. It would’ve been better if this was not the case since a value rotation to reversal have a very low success rate.

How was the Exit?

Got stopped out ‑1R

What would a price action-based exit have done for the trade?

-1R

What would a time-based exit have done for the trade?

-1R

What did I do well?

I did well to take my stop. I saw the buying tail getting taken out and I felt like cutting the trade but as I am re-learning to stick with a trade I decided to take my stop if need be. It got taken out 🙂

What could I have done better?

I could’ve better understood the narrative that after a value rotation price is less likely to reverse in a normal fashion. Plus if the profit target isn’t sufficient I shouldn’t be in the trade to begin with.

Observations

SL placement not good? DON’T TAKE THE TRADE! Subpar profit target? DON’T TAKE THE TRADE!

Missed Opportunity

N.A.

TAGS: above value, within range, moderate imbalance, trend is up 2/3,

Premarket prep on the day

Daily Report Card on the day

No Comments