12 Sep Best time to trade

When is the best time to trade?

When is the best time to trade? This is somewhat of a personal question. I believe it depends on a few criteria. Where are you located? Where is the exchange located that you would like to trade on? What kind of a trader are you (ie. scalper, day trader, swing trader, or a position trader?). The first two are important to answer, the third one as well although you might not know at this very moment what kind of trading suits you best. So before we get started….

DISCLAIMER

Like you, probably, I am learning how to trade. I don’t claim to know anything. What I do claim is that I will be a successful trader. I am confident that I will be one because I am putting in the time and effort. If I can’t become one, it’s because the game is rigged and I was never able to be good at it anyway. And basically the bottomline is… It’s never my fault 🙂

BECAUSE THE GAME IS RIGGED!

Obviously, I don’t believe this.

This series of posts are my personal approaches to understand markets and trading and in the end my path to success. So if you can be honest about your situation as I can be about mine, we can do this together and get cracking. If ‘they’ can do it… We can.

After all, you can’t be a good trader if you are not completely and brutally honest with yourself.

This series is called ‘The Honest Secrets to Trading’. I call it this because Yes, it is a ‘clickbait’ thing. Partly. How else can I get your attention amid all these other guys. But I also call it this because I will show you in all honesty what my approach to learning this craft is. Because I am looking for these secrets as well. Just like you. I am putting in the time. Are you?

Generally, you will find a common theme through my articles and that is GOOGLE for yourself. Don’t know a term that I’m talking about? GOOGLE it. I’m not here to tell you all there is about trading. I am here to tell you how I learn and how you can start learning by yourself. I hope you can appreciate that.

Here it goes…

Location Location Location

As the terms in real estate goes, it’s all about location location location. Well, not quite the same for trading but it is important. I hope you know where you are located so you at least have one part of the equation dealt with. Now find out where the financial instrument you want to trade is being traded. In my example I am going to use WTI crude oil because that’s what I trade.

A simple Google search ‘where is wti crude oil traded’ tells me it is being traded on the New York Mercantile Exchange (NYME) as an underlying futures contract. However because Forex and commodities are not bound by the trading hours of the New York Mercantile Exchange, I can trade these futures contracts 23 hours/day 5 days a week as I mentioned in another post before.

For me it means it’s a bit easier to trade since I am not bound by conventional trading hours. Let’s say I were to trade stocks on the New York Stock Exchange I would have to be trading them within its trading hours. Which would make it more difficult since if you are not located in the same time zone (or at least close to it).

Now figure out what your time zone is and that of the market you would like to trade. Now you have the time range figured out that you can be trading in.

Rush hour

Knowing when the store is open is just another part of the equation. Where some people would try to avoid the big mobs headed to the store, other strive. I know. Doesn’t make much sense right?! Most people like to avoid the busyness of shopping if they can. In trading however, that’s what I am looking for. We call it volatility. The bigger the volatility, the more action. And oh man!!! We LOVE action. Well, I do.

Detour

So how do you go about figuring out when those rush hours are? Well, I took the longer road thinking I would be onto something. It turns out that I could have done it easier. Having said that, there are definitely valuable insights to be had from looking at past price action. I looked at analyzing what I call the ‘big reversals’. Read here on ‘how to analyze historical price action’ and here on ‘understanding the big reversals’.

The shortcut

Take a look at the week and observe when big moves happen. Or, look for news events that can influence your financial instrument and look for correlating price moves in the charts. Take note of these and get on with building your trading schedule around them.

Make a trading schedule

Now that you have determined where and when you can trade, you can now go and put together a trading schedule. I like high volatility so that is what I am going to base my trading around. You have to determine that for yourself. Because I trade crude oil futures I like to trade around the reports from the American Petroleum Institute and the Energy Information Administration. See what factors influence your trading game and try to schedule around it.

Kinds of traders

So I talked about the different kinds of traders. The scalper basically gets in and out a position in matter of seconds to minutes, a day trader opens and closes them, as the name suggests, within the day. A swing trader takes trades that last a few days to weeks. Lastly a position trader is a trader that I like to look at as more of an investor. The position trader will hold trades for a longer period of time. For more information please go here https://www.babypips.com/learn/forex/summary-what-type-of-trader-are-you

Why does this matter to your trading game? I think it’s plausible to believe that your time frame strategy is somehow related to your trading schedule. Again, this is for everyone personally to find out.

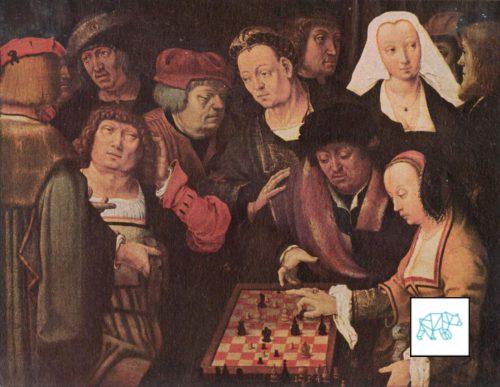

Playing Chess

However, there are different ways to build your strategy around it and I’ll definitely go into deeper in another post. What I can tell you now is that I compare trading to a chess game of sorts. Any given week is determined by a few factors that give the trading game a certain setup. Just like in a chess game, there is an opening, middle and end game. These all require different strategies for trading them. Like I said. I’ll dive deeper into this in another article. If you would like to be kept up-to-date, please subscribe. Or not. I’m getting back to my chess game. Or trading game. Whatever 🙂

Thank you for reading

Please subscribe if you haven’t already. Let me know what you think in the comments below. Unleash your negativity upon me! All good. Thanks for reading and happy trading to everyone.

No Comments