05 Feb Premarket Prep GBPNZD 02052021

#fintwit #orderflow #daytrading #premarketprep #GBPNZD #Forextrader #forex #FX #Forexlifestyle #daytrade #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife

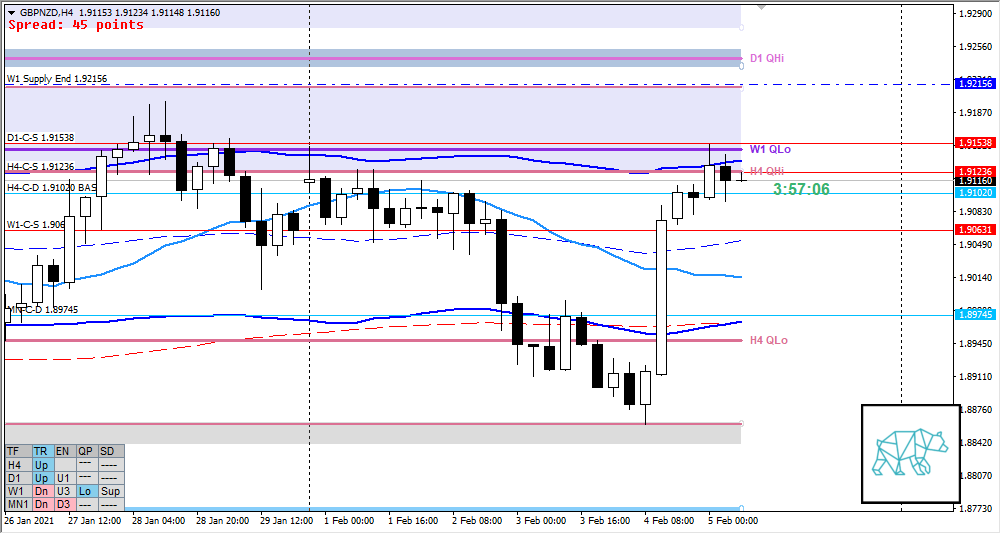

This is my premarket prep for today’s European session for the Forex pair GBPNZD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Weekly Focus Points

- Only take trades according to a hypo unless there are multiple conditions met

Compared against Weekly Trading Plan

- MN Morning Star completed last month with price currently trading above last month’s body

- W1 Bull Engulf at MN-C‑D 1.89745 with a RBR of which the base has been retraced to and exceeded below testing MN demand for a 2nd time and price is currently trading above last week’s body with a developing long buying wick (but we still need today to close for a confirmation)

- Key point would be taken out supply at W1 Supply End 1.92156 (W1-C‑S 1.90631)

- Price is trading within W1 QLo (no close above yet)

Non-conjecture observations of the market

- Price action

- D1 Bull Engulf at 50MA in R and MN demand reaching near UKC in R with price currently trade below D1-C‑S 1.91538

- Price is in top half of D1 swing with no arrival at D1 QHi (yet)

- Price traversed from H4 QLo on some momentum reaching QHi with a somewhat clean arrival (although there was some slowing down but still a RBR was formed, no reversal sign yet)

- Premarket: Price retraced to H4-C‑D 1.91020 BASE level but closed higher forming an inside bar with long buying wick

- Trend: H4 up, D1 up, W1 down

- Market Profile

- 2‑day bracket formed with yesterday’s value being very wide indicating a possible pickup in directional behaviour. Although currently the price is far above VAH that we might see a mean reversion first this could be the start of a new trend thus this would be risky at best.

- ADR: 1084

- ASR: 848

- 22

- Day

- Yesterday’s High 1.91110

- Yesterday’s Low 1.88605

Sentiment

- Locations

- H4 QLo at VAH

- ADR 0.5 and exhaustion low above VAH within range

- Sentiment

- LN open

- Above Value, Outside Range

- Open distance to value

- 1xADR, 1.4xASR

- Narrative

- Due to a potential break above W1 QLo we could see the start of a new trend thus negating a good mean reversion opportunity even though we opened far above VAH. Still due to H4 QHi and overhead we supply we could see some push back here. H4 retraced back to a base level signaling a possible initiative from sellers to return to the origin location at H4 QLo.

- LN open

- Clarity (1–5, 5 being best)

- 4

- Hypo 1 — Swing Reversal / Mean Reversion

- Narrative: Price having retraced to a base level plus consolidating below H4 QHi / D1-C‑S 1.91538 and open sentiment we could see a reversal here.

- Preferred: Confident bearish price action, IB extension down (or failed auction)

- Hypo 2 — Return to Value

- Narrative: medium/large timeframe possibility for a push higher.

- Preferred: IB extension down to Exhaustion level, price action and profile confirming a reversal through TPO structure build up or a failed auction.

- Hypo 3 — Trend Continuation

- Narrative: possible start of a new trend

- Preferred: Bullish Price action, IB extension (momentum) taking out overhead supply.

Additional notes

- Non-farm today

ZOIs for Possible Shorts

- H4-C‑S 1.91267

- D1-C‑S 1.90528

- W1-C‑S 1.90631

ZOIs for Possible Long

- H4-C‑D 1.90020 BASE

- MN-C‑D 1.89745

Mindful Trading

- Feeling okay

Focus Points for trading development

- Monthly Goals

- Continue tracking my DRC tracking sheet

- Focus on my own progress and less on others

- Feeling okay with NOT trading

- Have ‘quieter’ weekends

- Weekly Goal

- Min. 3 times hitting the gym

- Trading Rules

- Trade from D and upwards unless a possible momentum trade, value acceptance or otherwise.

- Risk Management

- 3 trades 1% risk, 3rd trade only if first 2 worked out

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING