04 Feb Premarket Prep Gold 02042021

GBPNZD in a too tight range thus focusing on Gold today.

#fintwit #orderflow #daytrading #premarketprep #XAUUSD #GOLD #Forextrader #forex #FX #Forexlifestyle #daytrade #tradeplan #tradingplan #tradingforex #tradinglifestyle #daytraderlife

This is my premarket prep for today’s European session for GOLD. This prep builds off of my weekly trade plan I made here:

The purpose of a premarket prep is to find setups within my weekly trade plan bias

Weekly Focus Points

- Only take trades according to a hypo unless there are multiple conditions met

Compared against Weekly Trading Plan

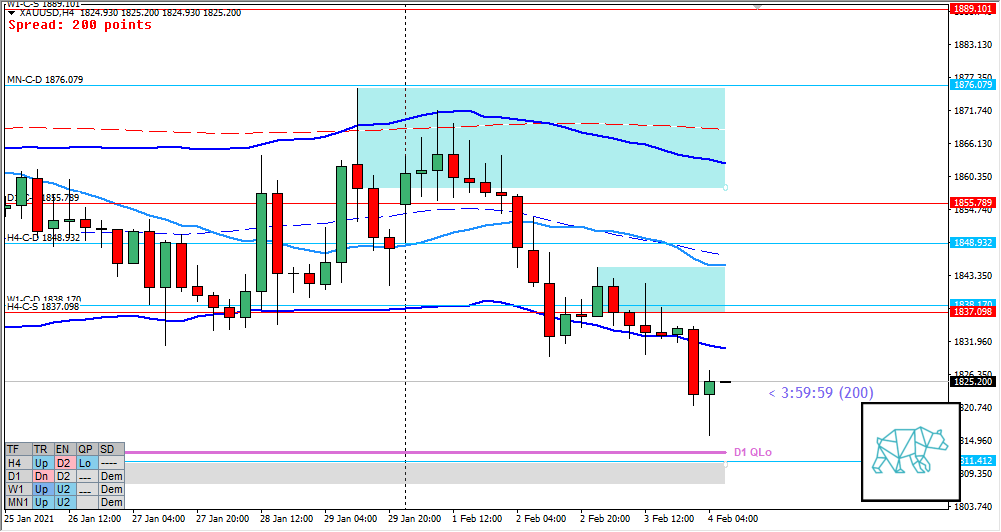

- Trading below last week’s spinning top testing W1 C‑dem below now nearing W1 50MA in UT and W1 QLo (for a 3rd test)

Non-conjecture observations of the market

- Price action

- D1 formed a spinning top with longer selling wick indicating a possible Base with price now trading below we might form a DBD

- Some H4 redistribution and consequent move away from H4-C‑S 1837.098 after multiple tests (not having reached D1 QLo yet but closed within H4 QLo)

- Premarket: some reaction off D1 QLO forming a H1 Bull Engulf and H4 Inside Bar with long buying wick.

- Trend

- Mixed trend: H4 up, D1 down, W1 up

- Market Profile

- Tight value created below previous value (making for 3 areas in DT)

- ADR: 27043

- ASR: 19492

- 490

- Day

- Yesterday’s High 1844.830

- Yesterday’s Low 1829.720

Sentiment

- Locations

- H4-C‑S 1837.098 at VAH

- Sentiment

- LN open

- Below Value, Outside Range

- Open distance to value

- 0.5xASR

- Narrative

- Price got near D1 QLo and is trading within H4 QLo but there is no close above H4 QLo (yet) and the H4 price action is still developing as we would need a 3rd candle close. D1 is showing a possible DBD so there is some conflicting narratives. Although the D1 narrative might near its end (as we are near W1 critical levels as well) and thus close higher from these levels but we would be certain of that in 4 hours. The open sentiment shows that for now the bears are still in control but it could really go either way as a mean reversion criteria is not (yet) fulfilled. Perhaps if price traverses further down before printing bullish price action we could perhaps see a mean reversion. Either way, going short is risky due to the amount of buyers around these levels. As always I will let the profile guide my trading decisions. For now on short term I am bearish that could transition in a long sentiment later on.

- LN open

- Clarity (1–5, 5 being best)

- 4

- Hypo 1 — Swing Reversal

- Narrative: D1 price has dropped quite some bit and we are trading at W1 critical levels that could see some push back. Price has come near D1 QLo with a clean arrival and printed a H4 Inside Bar with long buying wick within H4 QLo.

- Preferred: Strong Bullish Price action with momentum extension up. Sustained auction. Monitor for value acceptance although value is tight and there is a H4 C‑sup at VAH.

- Hypo 2 — Mean Reversion

- Narrative: D1 price has dropped quite some bit and we are trading at W1 critical levels that could see some push back.

- Preferred: Price traversing deeper down fulfilling mean reversion criteria accompanied with bullish reversal price action either within IB or after an extension down with failed auction. A move up to VAL would mean a retracement to D1 base and thus see more follow-through either in this session or possibly the next.

- Hypo 3 — Return to Value

- Narrative: D1 narrative with a pullback to value edge and continuation down.

- Preferred: TPO structure build up near VAL with Bearish price action reversal or a Single Print Fade.

- Hypo 4 — Trend Continuation

- Narrative: D1 DBD bearish sentiment with incomplete H4 price action formation could push price further down/

- Preferred: Strong Bearish Price action with IB extension down on momentum + sustained auction. Monitor for a sustained move taking out demand.

- Cons: very risky due to trade location

Additional notes

- BOE Monetary Policy Report (not sure if this has any influence on gold)

ZOIs for Possible Shorts

- W1-C‑S 1889.101

- D1-C‑S 1855.789

- H4-C‑S 1837.098

ZOIs for Possible Long

- W1-C‑D 1838.170

- H4-C‑D 1811.412 (@D1 Demand End and W1 50MA in UT)

Mindful Trading

- Feeling okay

Focus Points for trading development

- Monthly Goals

- Continue tracking my DRC tracking sheet

- Focus on my own progress and less on others

- Feeling okay with NOT trading

- Have ‘quieter’ weekends

- Weekly Goal

- Min. 3 times hitting the gym

- Trading Rules

- Trade from D and upwards unless a possible momentum trade, value acceptance or otherwise.

- Risk Management

- 3 trades 1% risk, 3rd trade only if first 2 worked out

- Capital Preservation during drawdown allows for 1R profit-taking

- 2 consecutive days of lack of sleep = NO TRADING

No Comments