12 Jun 20210610 Trade Review GBPNZD

Play: Trend Continuation to Failed Auction (2 trades)

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #GBPNZD

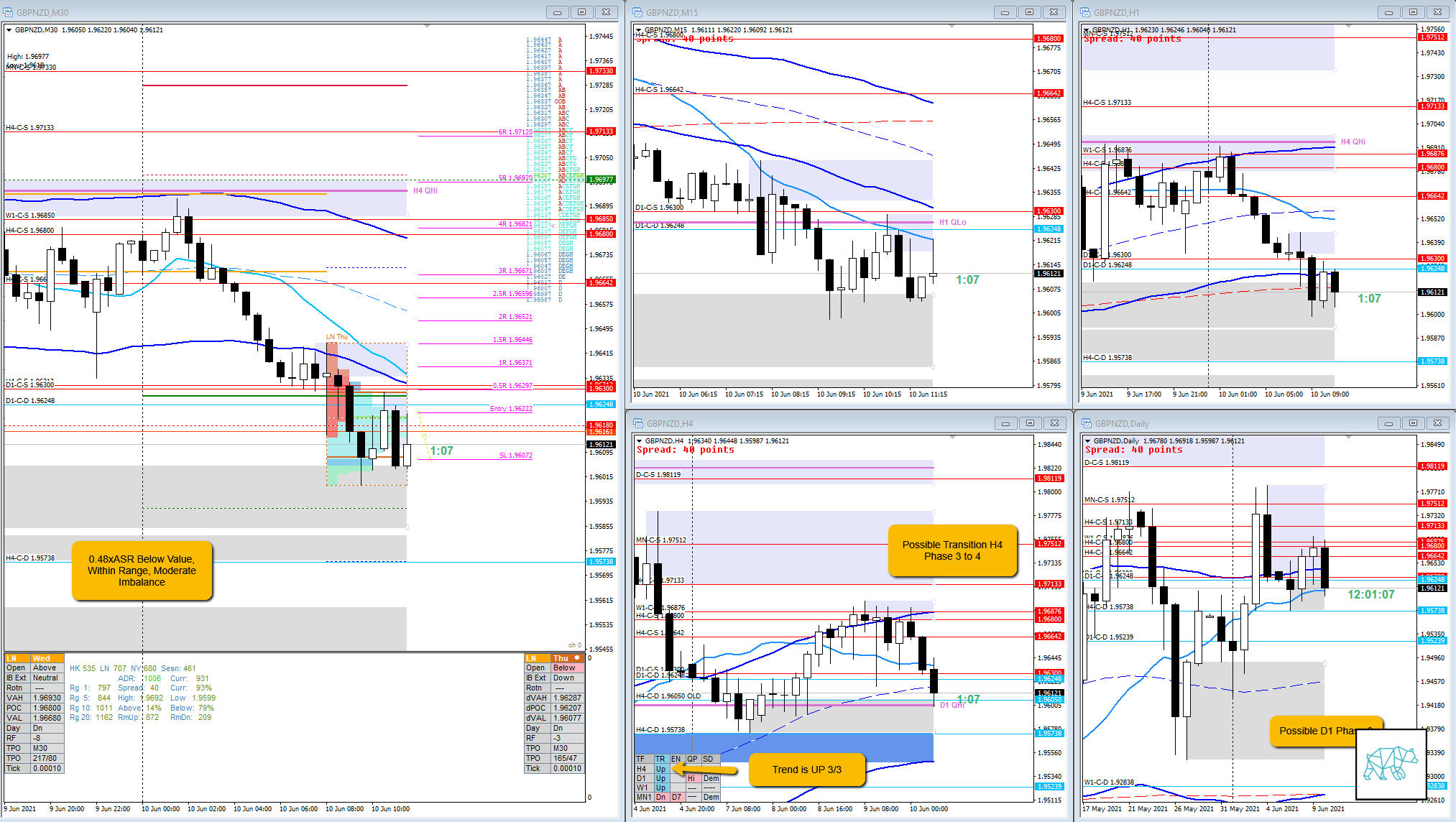

Market Narrative

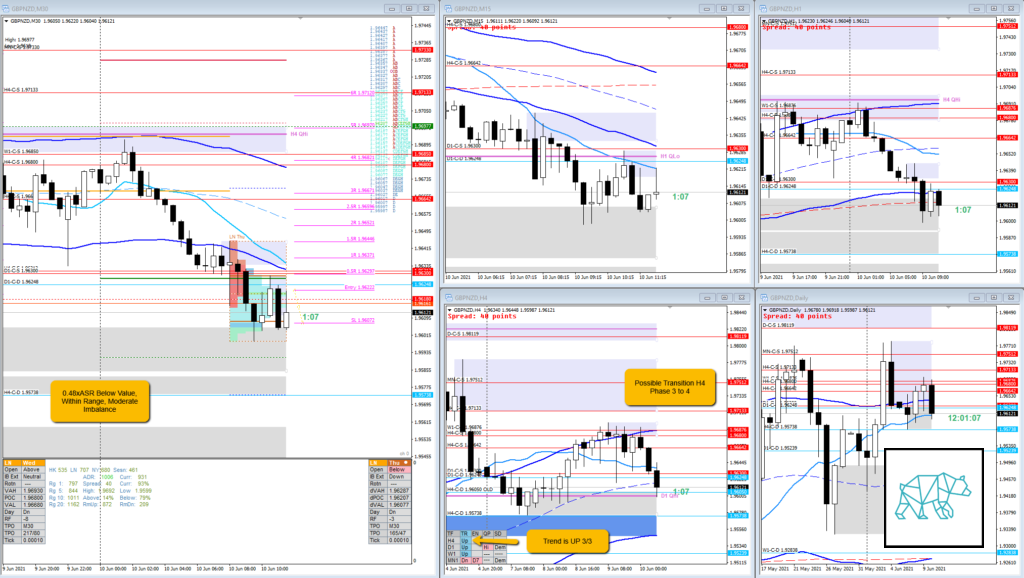

Even though a D1 Bull Engulf was formed and there was a slight continuation price was trading right into D1/W1 Supply. With a moderate imbalance below value, within range, the idea was strengthened for a possible transition from H4 Phase 3 to 4 as H4 closed deeper within demand and finally took it out during IB.

IB traded lower but did not close below Asia Low. Then C TPO extended IB down and closed below Asia low but within IB. D took it lower.

How was the Entry?

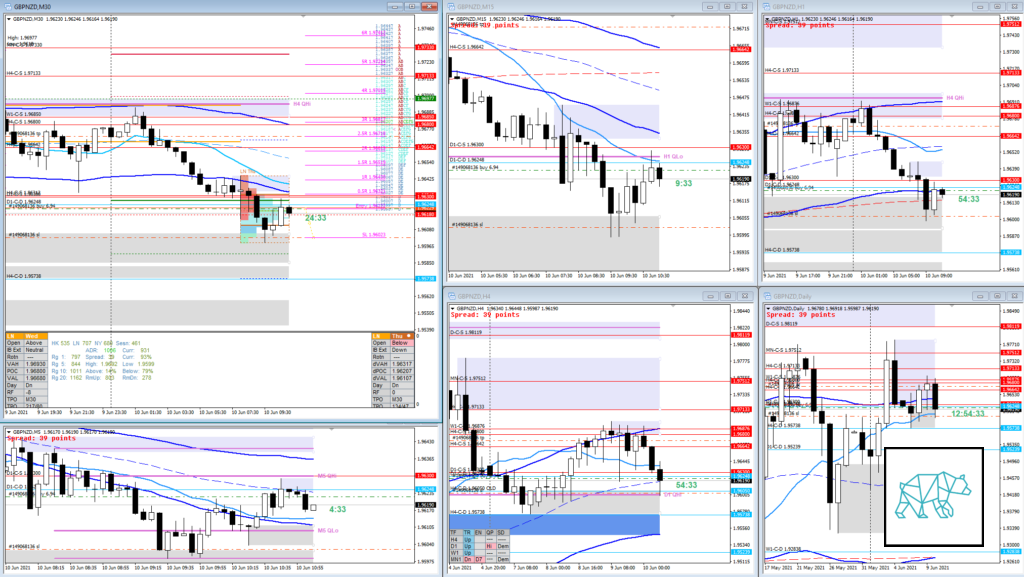

I hesitated on the entry of a break from IB due to C TPO not closing below IB. There was also a round number below 1.96000 and I expected a possible reaction before continuing down for a possible late-sustained auction entry. This came in E TPO with a test of IB Low.

How was the SL placement and sizing?

I had used a too wide SL and thus my sizing was off and I made it tighter by cutting some size and reentering with a tighter SL.

I messed up the resizing though which proved in my favor later on when I manually took the trade off.

How was the profit target?

Expecting a H4 phase 4 the target should have been okay.

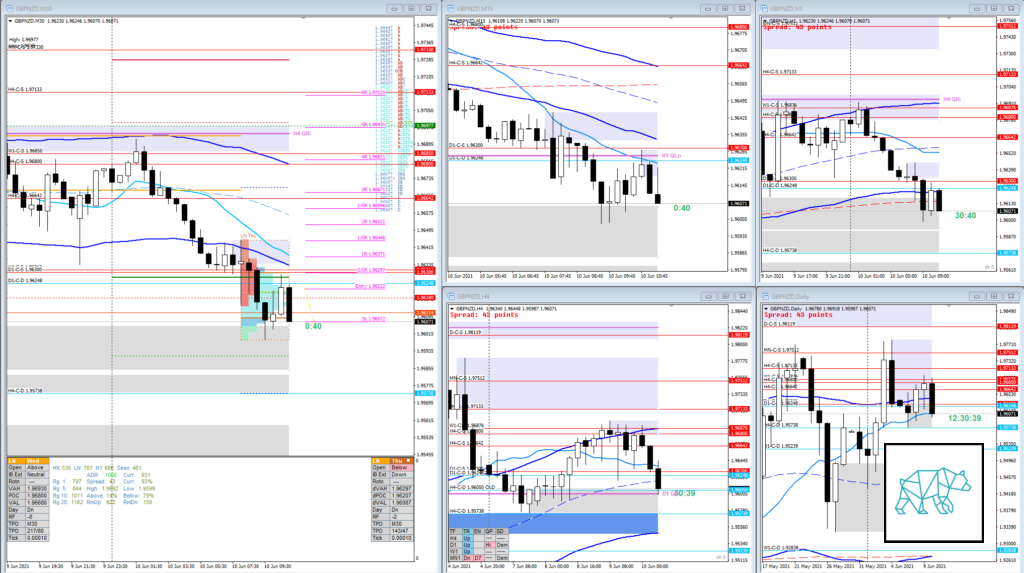

How was the Exit?

Exit was okay. Since E closed below IB the expectancy was for the auction to be sustained even though no LL was made. I took the trade off manually for ‑0.4R. This was also due to mismanaging the sizing that worked in my favor.

What would a price action-based exit have done for the trade?

A M15 Morning Star would have yielded a ‑0.3R loss.

What would a time-based exit have done for the trade?

0.3R

What did I do well?

I did well to take the trade and stick with the trade and let the market show me that my trading idea was invalidated. Although I could have done that based on the M15 Morning Star but the next bar retraced back to its new c‑dem and thus weakening that formation.

All this chop is most likely due to the summer time trading.

What could I have done better?

I think I did well… I am overcoming my Scooby Doo tendency that I have built up in the last few months. So it was good to just stay in a trade and live with it for a while.

Observations

Summertime chop can have a lot of contradicting PA.

2nd Trade

When F closed within IB failing the auction through a Three Inside Up I waited for a test of IB low to get involved. This did not pan out and I got stopped out. Gotta love summertime chop. G closed as a Bear Engulf and then proceeded to move higher afterwards.

Exit:

TAGS: Possible D1 Phase 3, Possible H4 Phase 3, Possible H4 Phase 4, Trend is UP 3/3, Below Value, Within Range, Moderate Imbalance,

Premarket prep on the day

Daily Report Card on the day

No Comments