21 Jul 20210719 Trade Review DAX

Play: Auction Fade, 2nd DTTZ Pullback

#fintwit #orderflow #daytrading #tradingreview #priceaction #chartreview #DAX #DE30 #DE30Cash

Market Narrative

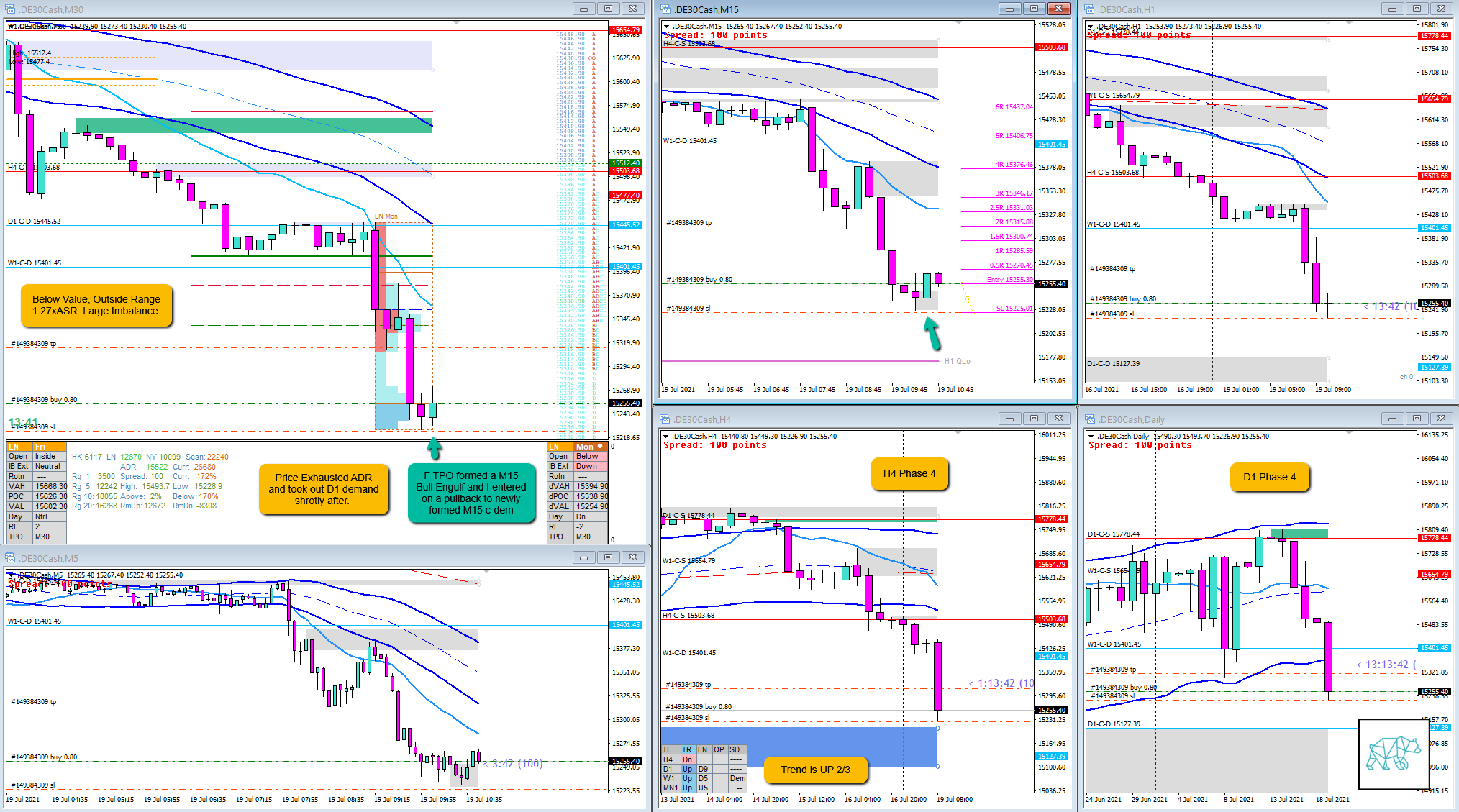

D1/H4 Phase 4, Trend is UP 2/3, and there was a large imbalance at the open which could favor a mean reversion. Instead due to the phase 4 there was a continuation to the move down. During 2nd DTTZ price often times give a pullback before continuing in the initial direction. This pullback is usually over within 1 TPO period. So have to be quick in and out.

How was the Entry?

Entry was good off of a pullback to newly formed M15 c‑dem from the Bull Engulf.

How was the SL placement and sizing?

SL placement was good right below the formation.

How was the profit target?

If there was a continuation to the (Auction Fade) move a test of IB low would have been about 2R.

How was the Exit?

Usually there is a bolt of momentum coming in pushing price higher ‘faking’ a reversal. When price failed to make a HH I took a 0.4R profit. This was okay as this move should happen in matter of minutes.

What would a price action-based exit have done for the trade?

If I had waited for the close of F TPO I would have also made 0.4R.

What would a time-based exit have done for the trade?

N.A. obviously would have gotten stopped out at ‑1R

What did I do well?

I did well to try out an opportunity based off an observation I have noticed in DAX.

What could I have done better?

I think I did well.

Observations

Often times in a sustained auction in DAX, there can be a pullback in the 2nd DTTZ. This pullback, if you can catch it, can be a very quick 2–3R. I will keep forward-testing this whenever I see them.

Missed Opportunity

TAGS: 2nd DTTZ Pullback, D1 Phase 4, H4 Phase 4, Below Value, Outside Range, Large Imbalance, ADR exhaustion, D1 demand popped,

Premarket prep on the day

Daily Report Card on the day

No Comments